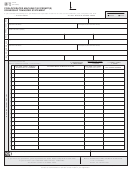

AP-141 (Back)

Texas Application for

(Rev.8-11/14)

Additional Coin-Operated Machine Tax Permits

Page 2

• Type or print.

• Do not write in shaded areas.

Legal name (Same as Item 2)

6. For each additional machine being placed on location and requiring a permit, list the serial number/inventory I.D. number, machine make and machine type.

Note: For registration certificate holders only: If the additional machines requiring permits are being placed in different locations, you MUST complete a separate

application for each location and list the machines placed in that location.

Machine Type

Exhibited

Machine Type

Exhibited

Machine Serial Number /

Machine Make or

Code Used

or

Machine Serial Number /

Machine Make or

Code Used

or

Inventory I.D. Number

Manufacturer

(Use letter codes

Displayed

Inventory I.D. Number

Manufacturer

(Use letter codes

Displayed

from Item 7)

from Item 7)

on Location

on Location

1.

11.

2.

12.

3.

13.

4.

14.

5.

15.

6.

16.

7.

17.

8.

18.

9.

19.

10.

20.

If additional space is needed, add supplemental page. Computer printout may be used.

7. Enter the total number of EACH TYPE of music, skill or pleasure coin-operated machines being placed in ALL locations for which you are purchasing additional tax

permits

– A –

– B –

– C –

– D –

– E –

– F –

Phonographs

Pool Tables

Pinball Games

Video Games

Darts

Other

8. Total number of additional machines in ALL locations that require tax permits. (Total of Item 7A - F) ...............................................................

_________________

Tax rate schedule for each coin-operated machine placed on location for the first time in:

1st quarter (January - March) ........................ $60.00

3rd quarter (July - September) ...................... $30.00

2nd quarter (April - June) .............................. $45.00

4th quarter (October - December) ................. $15.00

9. Calculate the total amount of occupation tax due for permits.

Multiply the number of machines placed on location for the first time in each calendar quarter by the appropriate tax rate for that quarter.

a. 1st quarter: _______________ machines at $60.00 each = $

________________

b. 2nd quarter: _______________ machines at $45.00 each = $

________________

c. 3rd quarter: _______________ machines at $30.00 each = $

________________

d. 4th quarter: _______________ machines at $15.00 each = $

________________

10. Total amount due for tax permits (Total Items 9a, 9b, 9c and 9d) .................................................................................... $ __________________

Note: Payment must be made payable to State Comptroller. Do not send cash.

11. Certification

I am applying for occupation tax permits for the coin-operated machine(s) which are listed in this application. I certify that all information submitted in

this application for tax permit(s) is true and correct.

Type or print name and title of sole owner, partner or officer

Driver license number / state

Sole owner, partner or officer

The law provides that a person who knowingly secures or attempts to secure a license by fraud, misrepresentation or subterfuge is guilty of a second degree felony

and upon conviction is punishable by confinement for two (2) to twenty (20) years and a fine up to $10,000. (Occupations Code §2153.357; Penal Code §12.33)

Business phone

Residence phone

(Area code and number)

(Area code and number)

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity

to conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available

online at You may also want to contact the municipality and county in which you will conduct business to

determine any local governmental requirements.

No. of permits issued ____________

Occupation Tax Permit(s) issued for ___________ :

Permit number _____________ through ___________

Field office number

E.O. name

User ID

Date

Reference number

1

1 2

2