Schedule O-720 (Form 41a720-O) - Other Additions And Subtractions To/from Federal Taxable Income

ADVERTISEMENT

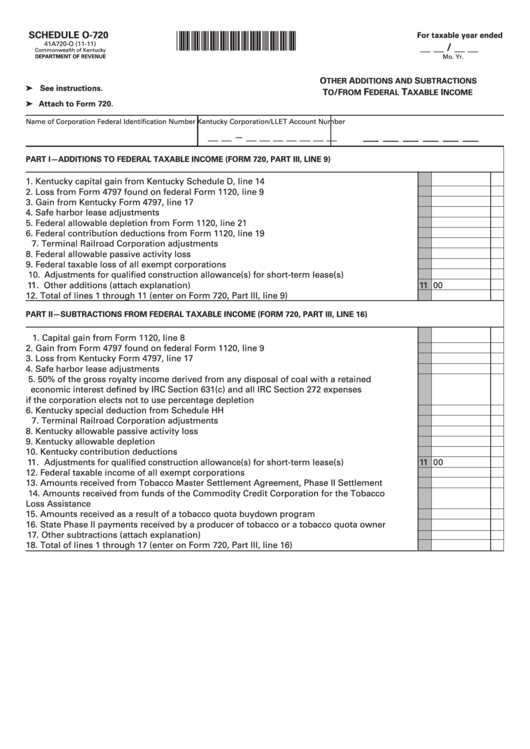

SCHEDULE O-720

For taxable year ended

*1100020300*

41A720-O (11-11)

__ __ / __ __

Commonwealth of Kentucky

Mo.

Yr.

DEPARTMENT OF REVENUE

O

A

S

THER

DDITIONS AND

UBTRACTIONS

➤ See instructions.

F

T

T

/F

I

O

ROM

EDERAL

AXABLE

NCOME

➤ Attach to Form 720.

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

__ __

__ __ __ __ __ __ __

—

PART I—ADDITIONS TO FEDERAL TAXABLE INCOME (FORM 720, PART III, LINE 9)

1. Kentucky capital gain from Kentucky Schedule D, line 14 ..........................................................

1

00

2. Loss from Form 4797 found on federal Form 1120, line 9 ..........................................................

2

00

3. Gain from Kentucky Form 4797, line 17 ........................................................................................

3

00

4. Safe harbor lease adjustments .....................................................................................................

4

00

5. Federal allowable depletion from Form 1120, line 21 .................................................................

5

00

6. Federal contribution deductions from Form 1120, line 19 ..........................................................

6

00

7. Terminal Railroad Corporation adjustments ................................................................................

7

00

8. Federal allowable passive activity loss ........................................................................................

8

00

9. Federal taxable loss of all exempt corporations .........................................................................

9

00

10. Adjustments for qualified construction allowance(s) for short-term lease(s)............................. 10

00

11. Other additions (attach explanation) ............................................................................................ 11

00

12. Total of lines 1 through 11 (enter on Form 720, Part III, line 9) ................................................... 12

00

PART II—SUBTRACTIONS FROM FEDERAL TAXABLE INCOME (FORM 720, PART III, LINE 16)

1. Capital gain from Form 1120, line 8 ..............................................................................................

1

00

2. Gain from Form 4797 found on federal Form 1120, line 9 ..........................................................

2

00

3. Loss from Kentucky Form 4797, line 17 ........................................................................................

3

00

4. Safe harbor lease adjustments .....................................................................................................

4

00

5. 50% of the gross royalty income derived from any disposal of coal with a retained

economic interest defined by IRC Section 631(c) and all IRC Section 272 expenses

if the corporation elects not to use percentage depletion ..........................................................

5

00

6. Kentucky special deduction from Schedule HH ...........................................................................

6

00

7. Terminal Railroad Corporation adjustments ................................................................................

7

00

8. Kentucky allowable passive activity loss .....................................................................................

8

00

9. Kentucky allowable depletion .......................................................................................................

9

00

10. Kentucky contribution deductions ................................................................................................ 10

00

11. Adjustments for qualified construction allowance(s) for short-term lease(s)............................. 11

00

12. Federal taxable income of all exempt corporations .................................................................... 12

00

13. Amounts received from Tobacco Master Settlement Agreement, Phase II Settlement ............ 13

00

14. Amounts received from funds of the Commodity Credit Corporation for the Tobacco

Loss Assistance Program............................................................................................................... 14

00

15. Amounts received as a result of a tobacco quota buydown program ...................................... 15

00

16. State Phase II payments received by a producer of tobacco or a tobacco quota owner ......... 16

00

17. Other subtractions (attach explanation) ....................................................................................... 17

00

18. Total of lines 1 through 17 (enter on Form 720, Part III, line 16) ................................................. 18

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2