Information and Pertinent Law Sections

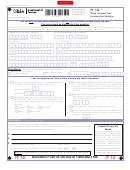

WT AR

Rev. 11/05

Page 2

1. All blanks on the front side of this application must be completed. Please type or print in ink.

2. This application must be fi led in duplicate. Please make copy for your records. Mail to:

Ohio Tax Commissioner

P.O. Box 2476

Columbus, OH 43216-2476

3. Ohio Revised Code (R.C.) section 5747.11(C) provides for the payment of interest at the rate prescribed by R.C. 5703.47) on all refunds

granted. To the extent a refund is granted on this application, either in whole or in part, the Department of Taxation will calculate and

include the appropriate amount of interest in the refund payment made to the applicant. The applicant should not include such interest

in the "total amount of claim" fi gure inserted on line 4-C.

4. Income tax withholding refunds are governed by R.C. 5747.11, which provides in pertinent part:

(A)

The tax commissioner shall refund to employers, qualify

or net capital loss arises. For purposes of the payment of

ing entities or taxpayers, with respect to any tax imposed

interest on overpayments, no amount of tax, for any taxable

under R.C. 5733.41, 5747.02 or 5747.41, or chapter

year, shall be treated as having been paid before the date

5748:

on which the tax return for that year was due without regard

(1) Overpayments of more than one dollar;

to any extension of time for fi ling such return.

(2) Amounts in excess of one dollar paid illegally or erro-

(3) Interest shall be allowed at the rate per annum prescribed

neously;

by R.C. 5703.47 on amounts refunded with respect to the

(3) Amounts in excess of one dollar paid on an illegal,

taxes imposed under R.C. 5733.41 and 5747.41. The in-

erroneous or excessive assessment.

terest shall run from whichever of the following days is the

(B)

Except as otherwise provided under divisions (D) and (E) of

latest until the day the refund is paid: the day the illegal,

this section, applications for refund shall be fi led with the tax

erroneous or excessive payment was made; the 90th day

commissioner, on the form prescribed by the commissioner,

after the fi nal day the annual report was required to be fi led

within four years from the date of the illegal, erroneous or

under R.C. 5747.42; or the 90th day after the day that report

excessive payment of the tax, or within any additional pe-

was fi led.

riod allowed by division (B)(3)(b) of ORC section 5747.05,

(D)

“Ninety days” shall be substituted for “four years” in division

division (B) of R.C. 5747.10, division (A) of R.C. 5747.13,

(B) of this section if the taxpayer satisfi es both of the follow-

or division (C) of R.C. 5747.45. On fi ling of the refund ap-

ing conditions:

plication, the commissioner shall determine the amount of

(1) The taxpayer has applied for a refund based in whole

refund due and certify such amount to the director of budget

or in part upon R.C. 5747.059;

and management and treasurer of state for payment from

(2) The taxpayer asserts that either the imposition or col-

the tax refund fund created by R.C. 5703.052.

lection of the tax imposed or charged by this chapter or

(C) (1) Interest shall be allowed and paid upon any illegal or er-

any portion of such tax violates the Constitution of the

roneous assessment in excess of one dollar in respect of

United States or the Constitution of Ohio.

the tax imposed under R.C. 5747.02 or chapter 5748 at the

(E)(1) Division (E)(2) of this section applies only if all of the follow-

rate per annum prescribed by R.C. 5703.47 from the date

ing conditions are satisfi ed:

of the payment of the illegal or erroneous assessment until

(a) A qualifying entity pays an amount of the tax imposed

the date the refund of such amount is paid. If such refund

by R.C. 5733.41 or 5747.41;

results from the fi ling of a return or report, or the payment

(b) The taxpayer is a qualifying investor as to that qualifying

accompanying such return or report, by an employer or

entity;

taxpayer, rather than from an assessment by the commis-

(c) The taxpayer did not claim the credit provided for in R.C.

sioner, such interest shall run from a period 90 days after

5747.059 as to the tax described in division (E)(1)(a) of

the fi nal fi ling date of the annual return until the date the

this section;

refund is paid.

(d) The four-year period described in division (B) of this

(2) Interest shall be allowed and paid at the rate per annum

section has ended as to the taxable year for which the

prescribed by R.C. 5703.47 upon any overpayment in ex-

taxpayer otherwise would have claimed that credit.

cess of one dollar in respect of the tax imposed under R.C.

(2) A taxpayer shall fi le an application for refund pursuant to

5747.02 or chapter 5748 from the date of the overpayment

division (E) of this section within one year after the date

until the date of the refund of the overpayment, except that

the payment described in division (E)(1)(a) of this section

if any overpayment is refunded within 90 days after the fi nal

is made. An application fi led under division (E)(2) of this

fi ling date of the annual return or 90 days after the return

section shall claim refund only of overpayments resulting

is fi led, whichever is later, no interest shall be allowed on

from the taxpayer’s failure to claim the credit described in

such overpayment. If the overpayment results from the car-

division (E)(1)(c) of this section. Nothing in division (E) of

ryback of a net operating loss or net capital loss to a previ-

this section shall be construed to relieve a taxpayer from

ous taxable year, the overpayment is deemed not to have

complying with division (A)(16) of R.C. 5747.01.

been made prior to the fi ling date, including any extension

thereof, for the taxable year in which the net operating loss

1

1 2

2