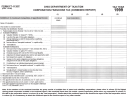

FT 1120C

Rev. 6/11

Page 5

2012 Instructions – See Ohio Revised Code Section (R.C.) 5733.052

Caution: As a result of the Ohio corporation franchise tax phase-

Timely Election. Taxpayers that elect to combine must do so in

commissioner’s permission to fi le a combined report with corpora-

out and the commercial activity tax phase-in, most corporations

a timely fi led report. A report is timely if it is fi led within the time

tions that are not taxpayers must fi le Ohio form FT COM. Nontax-

are not subject to the franchise tax for tax years (report

prescribed by R.C. 5733.02 as extended under R.C. 5733.13.

payer corporations included in a combined report must compute

years) 2010 and thereafter. Corporations that are not subject

A combination is timely elected under R.C. 5733.052(B) if any

income in the same manner as if they were taxpayers.

to the 2012 franchise tax (based on the taxable year ending

member of the combination has complied with all of the franchise

Interest and Penalty; Estimated Payments. To avoid penalty

in 2011) have no report year 2012 franchise tax payment or

tax report deadlines even if other members have not so complied.

and interest, each member of a combined franchise tax report

fi ling obligation. For all but the companies described below, the

Thus, a taxpayer that fails to pay its estimated tax by the required

must: (1) separately and timely fi le the Declaration of Estimated

franchise tax phase-out was complete with the fi ling of the 2009

dates and fails to separately fi le its request(s) for extension by the

Tax (Ohio form FT 1120E) and the request(s) for extension (Ohio

franchise tax report (based on the taxable year ending in 2008).

required dates may nevertheless fi le in combination with other

form FT 1120ER and FT 1120EX) and (2) pay the estimated tax

corporations after the due date of the taxpayer’s report if another

Exceptions to Franchise Tax Phase-Out. The following

due by the dates stated in general instructions 10A and 10B.

corporation in the combined group has timely paid its estimated

companies remain subject to the franchise tax for tax years

tax, has timely fi led its request(s) for extension, and has timely

Payment by Electronic Funds Transfer. For purposes of

2010 and thereafter: (i) fi nancial institutions, (ii) fi nancial holding

fi led its franchise tax report in combination with the taxpayer. See

determining whether members of a combined group are required

companies, (iii) bank holding companies, (iv) savings and loan

Roxane Laboratories, Inc. v. Tracy (1996), 75 Ohio St. 3d 125.

to pay by electronic fund transfer (EFT), group members must

holding companies, (v) affi liates of entities described in (i) through

However, each member of a combined report that fails to comply

add together their tax liabilities after reduction for nonrefundable

(iv) above when such affi liates are engaged in fi nancial institution-

with the fi ling and payment deadlines is subject to the applicable

credits for the second preceding tax year. If the combined group’s

type activities, (vi) certain affi liates of insurance companies when

penalty and interest charges.

aggregate tax liability after reduction for nonrefundable credits for

such affi liates are engaged in insurance-type activities, and (vii)

the second preceding tax year exceeded $50,000, then for the

“securitization” companies described in R.C. 5751.01(E)(10). See

Changing the Election. An election to combine may not

current tax year each member must remit its payments by EFT.

R.C. 5733.01(G) and 5751.01(E).

be changed by such taxpayers either in amended reports or

reports for future years without the written consent of the tax

Completing the Form. Two or more corporations filing in

Elected Combination. If the corporation is subject to the fran-

commissioner. The addition of a new member to a previously

combination must complete Ohio form FT 1120C, Corporation

chise tax for report year 2012, and if the taxpayer on Jan. 1 of

elected combination is a change in the combined group. See

Franchise Tax (Combined Report). Complete Combined Report

the tax year owns or controls either directly or indirectly more

R.C. 5733.052(B) and The Tranzonic Companies and Subs.

Schedules B, B-3, C (everywhere) and D in columnar form

than 50% of the voting stock of one or more taxpayer corpora-

v. Tracy, BTA Case No. 90-M-1443, Dec. 4 1992. Taxpayers

showing the line item fi gures for each individual corporation and

tions may elect to combine net income with such other taxpayer

seeking to change their existing combination must fi le Ohio

the combined totals of each line item after the elimination of

corporations. A “taxpayer” is a corporation subject to the franchise

form FT COM, Request for Permission to File or to Amend a

intercorporate transactions between corporations in the

tax. Taxpayers whose voting stock on Jan. 1 of the tax year is

Combined Corporation Franchise Tax Report. The deletion from

combined group. Schedule B-3 (combined) must be completed

more than 50% owned or controlled either directly or indirectly

the combination of a member that is no longer subject to the

in accordance with the instructions below (see May 6, 1992

by another corporation or by related interests may also elect to

franchise tax because of the phase-out is not a change in the

franchise tax information release “Schedule B-3 (combined)

combine net income. That is, brother-sister taxpayer corpora-

election.

Related Entity and Related Member Adjustments for Corporations

tions owned by an individual may elect to combine net income,

Included in a Combined Franchise Tax Report”). Complete

and brother-sister taxpayer corporations owned by a parent

Required or Permitted Combination. If on Jan. 1 of the tax year

additional pages if needed to refl ect the number of members

corporation may elect to combine net income without inclusion

the combined report’s more than 50% ownership requirement

included in the combination.

of the parent corporation. However, where less than all eligible

is met (see “Elected Combination” paragraph, above), the tax

taxpayer corporations elect to combine net income, the group

commissioner may require or permit a taxpayer and another

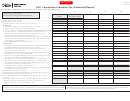

After completing the combined report, each taxpayer must enter

must include an explanation for the nonparticipation by such

corporation to combine their net income (whether or not the other

on its own separate franchise tax report, Ohio form FT 1120, the

eligible taxpayer corporations. Net worth is not combined; each

corporation is a taxpayer and whether or not the other corporation

following: (1) the taxpayer’s apportioned income from Schedule B

member of a combined report must determine its net worth and

has income from sources within Ohio on a separate company

(combined), line 7, and (2) the taxpayer’s related entity and related

net-worth base tax on its separate franchise tax report.

basis). The department will require franchise tax combinations

member adjustment from Schedule B-3 (combined), line 21. Each

and will pursue expanded combinations where the department

taxpayer must then compute its own Ohio allocable income, Ohio

Ohio Income Requirement. Each taxpayer in an elected

ascertains that the failure to combine income distorts the amount

taxable income and net income base tax and its net worth base

combination must have income, other than dividend income, from

of income fairly apportioned and allocated to Ohio. For purposes

tax. Each member of a combined group has its own Ohio net

sources within Ohio (either positive income or negative income

of ascertaining whether such income distortion exists, the

operating loss deduction because each member computes its own

[loss]). “Income from sources within Ohio” means income that

department will consider all relevant evidence.

Ohio taxable income on its own franchise tax report, Ohio form FT

would be allocated or apportioned to Ohio if the taxpayer were not

1120. Each member of the combined group with a balance due

included in a combined report. Those taxpayer groups that elected

See the department’s information release entitled “I.R.C. Section

must make payment with its franchise tax report. Each member

to combine in prior tax years must amend their combinations to

482 Study: Taxpayers Seeking To Avoid Ohio Corporate Franchise

with an overpayment will receive a refund or, if the corporation

delete taxpayers that during the taxable year did not have income,

Tax Report Required or Expanded Combinations,” issued June

requests, a credit toward the corporation’s estimated tax for the

other than dividend income, from sources within Ohio.

2000 and revised January 2005. Taxpayers requesting the tax

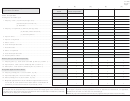

1

1 2

2 3

3 4

4 5

5 6

6