Form I - Financial Information Page 4

ADVERTISEMENT

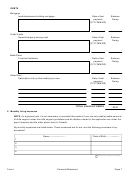

Projected income for special or extraordinary expenses amount

7.

Annual income for child support guidelines table amount (pay records)

8.

(+)

Plus spousal support received from the other parent (if applicable)

9.

Minus spousal support paid to the other parent (if applicable)

(-)

10.

(=)

$0.00

Annual income for special or extraordinary expenses amount

5. Other child support and benefits

Complete this part if:

You are claiming support for a child over the age of majority, and/or

You are claiming an amount different than the child support guidelines table amount.

A.

I receive child support for a child(ren) other than the child(ren) in this application:

Name

Date of Birth

(First Middle Last)

(YYYY/MM/DD)

1.

2.

3.

4.

Additional page(s) attached

Annual Amount Received:

B.

I receive non-taxable benefits, allowances, or amounts. (Example: use of a vehicle, childcare, or

room and board. If the benefit is not an amount, include an estimate of the annual value of the

benefit.)

Benefits received:

Annual Amount or Estimate:

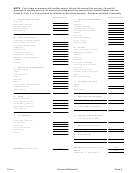

6. Household income

Complete this part if you are living with another person(s) and:

You are claiming support for yourself

You are making an undue hardship claim

You believe the Respondent may make an undue hardship claim.

The following person or persons reside in this residence and contribute to the household income.

NOTE: Your living/marital relationship is not the issue; it is about sharing household expenses.

Name of Person #1:

Works at (name of employer, occupation)

Earns

per

(year)

Pays for about

% of household expenses

Does not work

Has no earnings

Contributes no money to the household expenses

This person has child(ren) living in the home with us (name and age of each child).

Form I

Financial Statement

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9