Department of the Treasury

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI

001

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI

012345678

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

-123456789012345

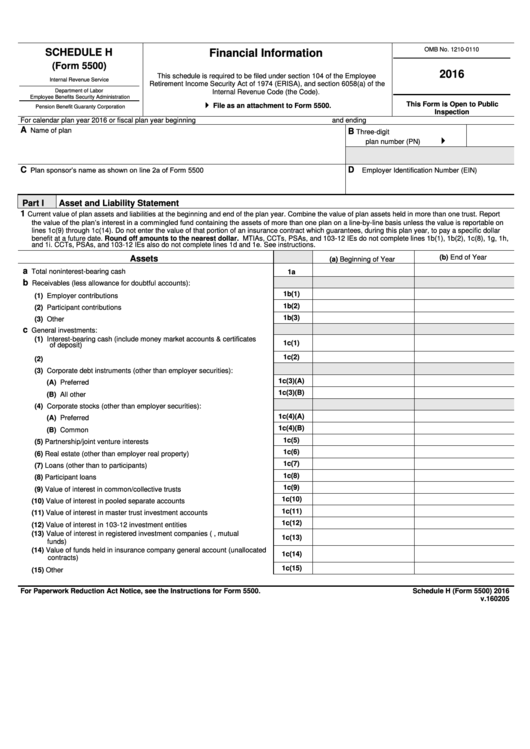

OMB No. 1210-0110

SCHEDULE H

Financial Information

(Form 5500)

2016

This schedule is required to be filed under section 104 of the Employee

Internal Revenue Service

Retirement Income Security Act of 1974 (ERISA), and section 6058(a) of the

Department of Labor

Internal Revenue Code (the Code).

Employee Benefits Security Administration

This Form is Open to Public

File as an attachment to Form 5500.

Pension Benefit Guaranty Corporation

Inspection

For calendar plan year 2016 or fiscal plan year beginning

and ending

A

Name of plan

B

Three-digit

plan number (PN)

Plan sponsor’s name as shown on line 2a of Form 5500

C

D

Employer Identification Number (EIN)

Part I

Asset and Liability Statement

1

Current value of plan assets and liabilities at the beginning and end of the plan year. Combine the value of plan assets held in more than one trust. Report

the value of the plan’s interest in a commingled fund containing the assets of more than one plan on a line-by-line basis unless the value is reportable on

lines 1c(9) through 1c(14). Do not enter the value of that portion of an insurance contract which guarantees, during this plan year, to pay a specific dollar

benefit at a future date. Round off amounts to the nearest dollar. MTIAs, CCTs, PSAs, and 103-12 IEs do not complete lines 1b(1), 1b(2), 1c(8), 1g, 1h,

and 1i. CCTs, PSAs, and 103-12 IEs also do not complete lines 1d and 1e. See instructions.

Assets

(a) Beginning of Year

(b) End of Year

a

Total noninterest-bearing cash ......................................................................

1a

b

Receivables (less allowance for doubtful accounts):

1b(1)

(1) Employer contributions ..........................................................................

1b(2)

(2) Participant contributions ........................................................................

1b(3)

(3) Other .....................................................................................................

c

General investments:

(1) Interest-bearing cash (include money market accounts & certificates

1c(1)

of deposit) ............................................................................................

1c(2)

(2) U.S. Government securities ..................................................................

(3) Corporate debt instruments (other than employer securities):

1c(3)(A)

(A) Preferred ........................................................................................

1c(3)(B)

(B) All other ..........................................................................................

(4) Corporate stocks (other than employer securities):

1c(4)(A)

(A) Preferred ........................................................................................

1c(4)(B)

(B) Common .........................................................................................

1c(5)

(5) Partnership/joint venture interests .........................................................

1c(6)

(6) Real estate (other than employer real property) .....................................

1c(7)

(7) Loans (other than to participants) ..........................................................

1c(8)

(8) Participant loans ....................................................................................

1c(9)

(9) Value of interest in common/collective trusts .........................................

1c(10)

(10) Value of interest in pooled separate accounts .......................................

1c(11)

(11) Value of interest in master trust investment accounts ............................

1c(12)

(12) Value of interest in 103-12 investment entities .......................................

(13) Value of interest in registered investment companies (e.g., mutual

1c(13)

funds) ....................................................................................

(14) Value of funds held in insurance company general account (unallocated

1c(14)

contracts) ..............................................................................................

1c(15)

(15) Other .....................................................................................................

For Paperwork Reduction Act Notice, see the Instructions for Form 5500.

Schedule H (Form 5500) 2016

v.160205

1

1 2

2 3

3 4

4