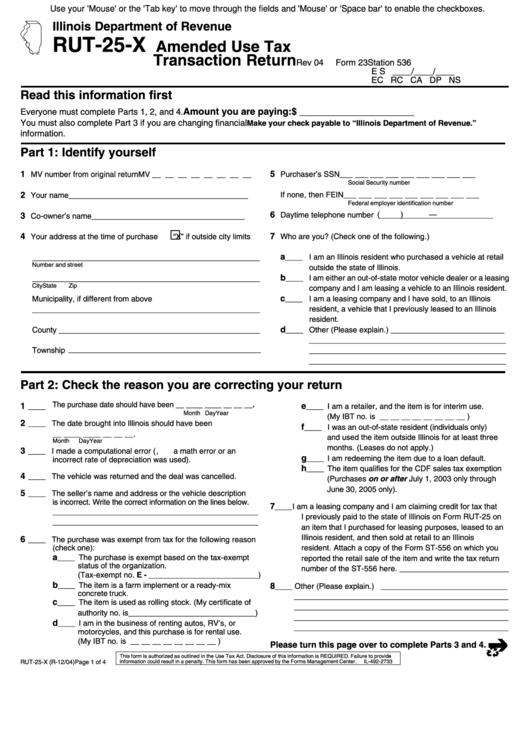

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

RUT-25-X

Amended Use Tax

Transaction Return

Rev 04

Form 23

Station 536

E S ____/____/____

EC RC CA DP NS

Read this information first

Amount you are paying: $ ______________________

Everyone must complete Parts 1, 2, and 4.

You must also complete Part 3 if you are changing financial

Make your check payable to “Illinois Department of Revenue.”

information.

Part 1: Identify yourself

1

5

MV number from original return MV __ __ __ __ __ __ __ __

Purchaser’s SSN

___ ___ ___ ___ ___ ___ ___ ___ ___

Social Security number

2

If none, then FEIN ___ ___ ___ ___ ___ ___ ___ ___ ___

Your name

_________________________________________

Federal employer identification number

6

(

)

—

3

Daytime telephone number __________________________

Co-owner’s name

___________________________________

4

7

Your address at the time of purchase

“X” if outside city limits

Who are you? (Check one of the following.)

a

____________________________________________________

____ I am an Illinois resident who purchased a vehicle at retail

Number and street

outside the state of Illinois.

b

____ I am either an out-of-state motor vehicle dealer or a leasing

____________________________________________________

City

State

Zip

company and I am leasing a vehicle to an Illinois resident.

c

____ I am a leasing company and I have sold, to an Illinois

Municipality, if different from above

resident, a vehicle that I previously leased to an Illinois

____________________________________________________

resident.

d

____ Other (Please explain.) __________________________

County ______________________________________________

_____________________________________________

Township ____________________________________________

_____________________________________________

_____________________________________________

Part 2: Check the reason you are correcting your return

1

e

____ The purchase date should have been __ __ __ __ __ __ __ __.

____ I am a retailer, and the item is for interim use.

Month Day

Year

(My IBT no. is __ __ __ __ __ __ __ __ )

2

____ The date brought into Illinois should have been

f

____ I was an out-of-state resident (individuals only)

__ __ __ __ __ __ __ __.

and used the item outside Illinois for at least three

Month

Day

Year

months. (Leases do not apply.)

3

____ I made a computational error ( e.g., a math error or an

g

____ I am redeeming the item due to a loan default.

incorrect rate of depreciation was used).

h

____ The item qualifies for the CDF sales tax exemption

4

____ The vehicle was returned and the deal was cancelled.

(Purchases on or after July 1, 2003 only through

June 30, 2005 only).

5

____ The seller’s name and address or the vehicle description

is incorrect. Write the correct information on the lines below.

7

____

I am a leasing company and I am claiming credit for tax that

_______________________________________________

I previously paid to the state of Illinois on Form RUT-25 on

_______________________________________________

an item that I purchased for leasing purposes, leased to an

Illinois resident, and then sold at retail to an Illinois

6

____ The purchase was exempt from tax for the following reason

(check one):

resident. Attach a copy of the Form ST-556 on which you

a

____ The purchase is exempt based on the tax-exempt

reported the retail sale of the item and write the tax return

status of the organization.

number of the ST-556 here. _________________________

(Tax-exempt no. E - _________________________)

b

____ The item is a farm implement or a ready-mix

8

____ Other (Please explain.) _____________________________

concrete truck.

_________________________________________________

c

____ The item is used as rolling stock. (My certificate of

_________________________________________________

authority no. is _____________________________)

_________________________________________________

d

____ I am in the business of renting autos, RV’s, or

_________________________________________________

motorcycles, and this purchase is for rental use.

(My IBT no. is __ __ __ __ __ __ __ __ )

Please turn this page over to complete Parts 3 and 4.

This form is authorized as outlined in the Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2733

RUT-25-X (R-12/04)

Page 1 of 4

1

1 2

2