Instructions For Form St -556-X - Amended Sales Tax Transaction Return

ADVERTISEMENT

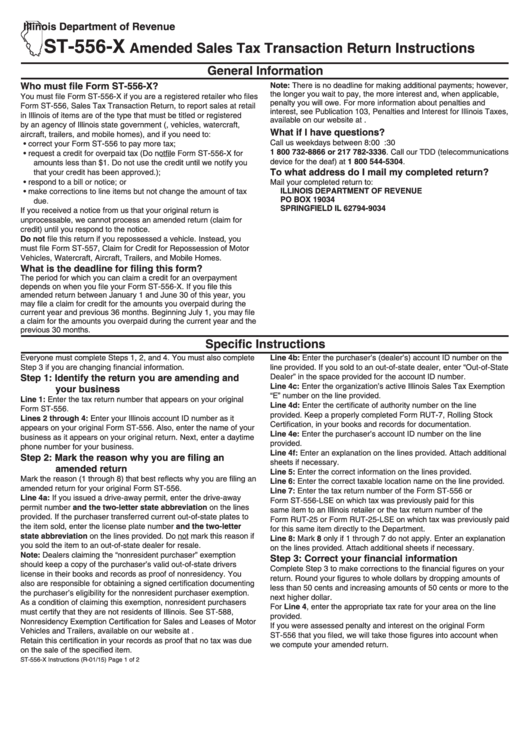

Illinois Department of Revenue

ST-556-X

Amended Sales Tax Transaction Return Instructions

General Information

Who must file Form ST-556-X?

Note: There is no deadline for making additional payments; however,

the longer you wait to pay, the more interest and, when applicable,

You must file Form ST-556-X if you are a registered retailer who files

penalty you will owe. For more information about penalties and

Form ST-556, Sales Tax Transaction Return, to report sales at retail

interest, see Publication 103, Penalties and Interest for Illinois Taxes,

in Illinois of items are of the type that must be titled or registered

available on our website at tax.illinois.gov.

by an agency of Illinois state government (i.e., vehicles, watercraft,

What if I have questions?

aircraft, trailers, and mobile homes), and if you need to:

Call us weekdays between 8:00 a.m. and 4:30 p.m. at

• correct your Form ST-556 to pay more tax;

1 800 732-8866 or 217 782-3336. Call our TDD (telecommunications

• request a credit for overpaid tax (Do not file Form ST-556-X for

device for the deaf) at 1 800 544-5304.

amounts less than $1. Do not use the credit until we notify you

To what address do I mail my completed return?

that your credit has been approved.);

• respond to a bill or notice; or

Mail your completed return to:

ILLINOIS DEPARTMENT OF REVENUE

• make corrections to line items but not change the amount of tax

PO BOX 19034

due.

SPRINGFIELD IL 62794-9034

If you received a notice from us that your original return is

unprocessable, we cannot process an amended return (claim for

credit) until you respond to the notice.

Do not file this return if you repossessed a vehicle. Instead, you

must file Form ST-557, Claim for Credit for Repossession of Motor

Vehicles, Watercraft, Aircraft, Trailers, and Mobile Homes.

What is the deadline for filing this form?

The period for which you can claim a credit for an overpayment

depends on when you file your Form ST-556-X. If you file this

amended return between January 1 and June 30 of this year, you

may file a claim for credit for the amounts you overpaid during the

current year and previous 36 months. Beginning July 1, you may file

a claim for the amounts you overpaid during the current year and the

previous 30 months.

Specific Instructions

Everyone must complete Steps 1, 2, and 4. You must also complete

Line 4b: Enter the purchaser’s (dealer’s) account ID number on the

Step 3 if you are changing financial information.

line provided. If you sold to an out-of-state dealer, enter “Out-of-State

Step 1: Identify the return you are amending and

Dealer” in the space provided for the account ID number.

Line 4c: Enter the organization’s active Illinois Sales Tax Exemption

your business

“E” number on the line provided.

Line 1: Enter the tax return number that appears on your original

Line 4d: Enter the certificate of authority number on the line

Form ST-556.

provided. Keep a properly completed Form RUT-7, Rolling Stock

Lines 2 through 4: Enter your Illinois account ID number as it

Certification, in your books and records for documentation.

appears on your original Form ST-556. Also, enter the name of your

Line 4e: Enter the purchaser’s account ID number on the line

business as it appears on your original return. Next, enter a daytime

provided.

phone number for your business.

Line 4f: Enter an explanation on the lines provided. Attach additional

Step 2: Mark the reason why you are filing an

sheets if necessary.

amended return

Line 5: Enter the correct information on the lines provided.

Mark the reason (1 through 8) that best reflects why you are filing an

Line 6: Enter the correct taxable location name on the line provided.

amended return for your original Form ST-556.

Line 7: Enter the tax return number of the Form ST-556 or

Line 4a: If you issued a drive-away permit, enter the drive-away

Form ST-556-LSE on which tax was previously paid for this

permit number and the two-letter state abbreviation on the lines

same item to an Illinois retailer or the tax return number of the

provided. If the purchaser transferred current out-of-state plates to

Form RUT-25 or Form RUT-25-LSE on which tax was previously paid

the item sold, enter the license plate number and the two-letter

for this same item directly to the Department.

state abbreviation on the lines provided. Do not mark this reason if

Line 8: Mark 8 only if 1 through 7 do not apply. Enter an explanation

you sold the item to an out-of-state dealer for resale.

on the lines provided. Attach additional sheets if necessary.

Note: Dealers claiming the “nonresident purchaser” exemption

Step 3: Correct your financial information

should keep a copy of the purchaser’s valid out-of-state drivers

Complete Step 3 to make corrections to the financial figures on your

license in their books and records as proof of nonresidency. You

return. Round your figures to whole dollars by dropping amounts of

also are responsible for obtaining a signed certification documenting

less than 50 cents and increasing amounts of 50 cents or more to the

the purchaser’s eligibility for the nonresident purchaser exemption.

next higher dollar.

As a condition of claiming this exemption, nonresident purchasers

For Line 4, enter the appropriate tax rate for your area on the line

must certify that they are not residents of Illinois. See ST-588,

provided.

Nonresidency Exemption Certification for Sales and Leases of Motor

If you were assessed penalty and interest on the original Form

Vehicles and Trailers, available on our website at tax.illinois.gov.

ST-556 that you filed, we will take those figures into account when

Retain this certification in your records as proof that no tax was due

we compute your amended return.

on the sale of the specified item.

ST-556-X Instructions (R-01/15)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2