Instructions

Print

Reset

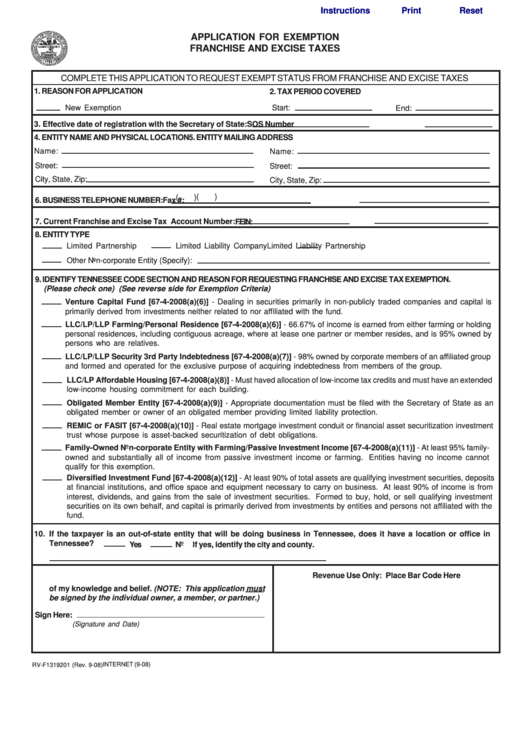

APPLICATION FOR EXEMPTION

FRANCHISE AND EXCISE TAXES

COMPLETE THIS APPLICATION TO REQUEST EXEMPT STATUS FROM FRANCHISE AND EXCISE TAXES

1. REASON FOR APPLICATION

2. TAX PERIOD COVERED

New Exemption

Start:

End:

3. Effective date of registration with the Secretary of State:

SOS Number

4. ENTITY NAME AND PHYSICAL LOCATION

5. ENTITY MAILING ADDRESS

Name:

Name:

Street:

Street:

City, State, Zip:

City, State, Zip:

(

)

(

)

6. BUSINESS TELEPHONE NUMBER:

Fax #:

7. Current Franchise and Excise Tax Account Number:

FEIN:

8. ENTITY TYPE

Limited Liability Company

Limited Liability Partnership

Limited Partnership

Other Non-corporate Entity (Specify):

9. IDENTIFY TENNESSEE CODE SECTION AND REASON FOR REQUESTING FRANCHISE AND EXCISE TAX EXEMPTION.

(Please check one) (See reverse side for Exemption Criteria)

Venture Capital Fund [67-4-2008(a)(6)] - Dealing in securities primarily in non-publicly traded companies and capital is

primarily derived from investments neither related to nor affiliated with the fund.

LLC/LP/LLP Farming/Personal Residence [67-4-2008(a)(6)] - 66.67% of income is earned from either farming or holding

personal residences, including contiguous acreage, where at lease one partner or member resides, and is 95% owned by

persons who are relatives.

LLC/LP/LLP Security 3rd Party Indebtedness [67-4-2008(a)(7)] - 98% owned by corporate members of an affiliated group

and formed and operated for the exclusive purpose of acquiring indebtedness from members of the group.

LLC/LP Affordable Housing [67-4-2008(a)(8)] - Must haved allocation of low-income tax credits and must have an extended

low-income housing commitment for each building.

Obligated Member Entity [67-4-2008(a)(9)] - Appropriate documentation must be filed with the Secretary of State as an

obligated member or owner of an obligated member providing limited liability protection.

REMIC or FASIT [67-4-2008(a)(10)] - Real estate mortgage investment conduit or financial asset securitization investment

trust whose purpose is asset-backed securitization of debt obligations.

Family-Owned Non-corporate Entity with Farming/Passive Investment Income [67-4-2008(a)(11)] - At least 95% family-

owned and substantially all of income from passive investment income or farming. Entities having no income cannot

qualify for this exemption.

Diversified Investment Fund [67-4-2008(a)(12)] - At least 90% of total assets are qualifying investment securities, deposits

at financial institutions, and office space and equipment necessary to carry on business. At least 90% of income is from

interest, dividends, and gains from the sale of investment securities. Formed to buy, hold, or sell qualifying investment

securities on its own behalf, and capital is primarily derived from investments by entities and persons not affiliated with the

fund.

10. If the taxpayer is an out-of-state entity that will be doing business in Tennessee, does it have a location or office in

Tennessee?

Yes

No

If yes, identify the city and county.

Revenue Use Only: Place Bar Code Here

11. The statements made on this application are true to the best

of my knowledge and belief. (NOTE: This application must

be signed by the individual owner, a member, or partner.)

Sign Here:

(Signature and Date)

INTERNET (9-08)

RV-F1319201 (Rev. 9-08)

1

1 2

2