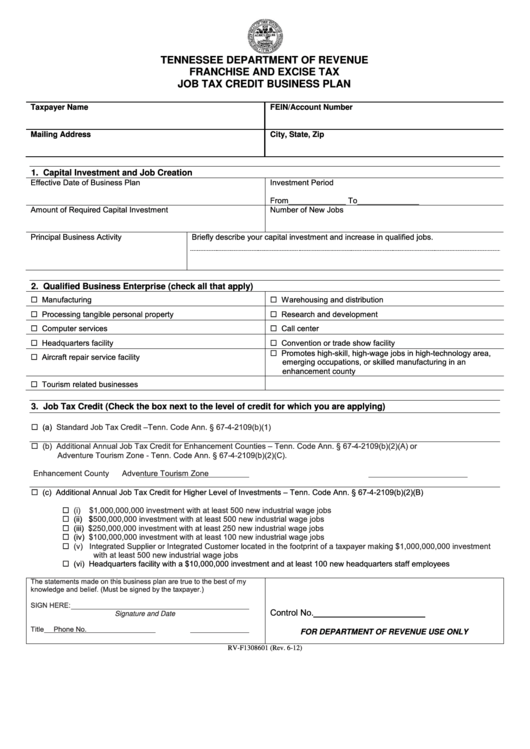

TENNESSEE DEPARTMENT OF REVENUE

FRANCHISE AND EXCISE TAX

JOB TAX CREDIT BUSINESS PLAN

Taxpayer Name

FEIN/Account Number

Mailing Address

City, State, Zip

1. Capital Investment and Job Creation

Effective Date of Business Plan

Investment Period

From_____________ To______________

Amount of Required Capital Investment

Number of New Jobs

Principal Business Activity

Briefly describe your capital investment and increase in qualified jobs.

2. Qualified Business Enterprise (check all that apply)

Manufacturing

Warehousing and distribution

Processing tangible personal property

Research and development

Computer services

Call center

Headquarters facility

Convention or trade show facility

Promotes high-skill, high-wage jobs in high-technology area,

Aircraft repair service facility

emerging occupations, or skilled manufacturing in an

enhancement county

Tourism related businesses

3. Job Tax Credit (Check the box next to the level of credit for which you are applying)

(a)

Standard Job Tax Credit –Tenn. Code Ann. § 67-4-2109(b)(1)

(b) Additional Annual Job Tax Credit for Enhancement Counties – Tenn. Code Ann. § 67-4-2109(b)(2)(A) or

Adventure Tourism Zone - Tenn. Code Ann. § 67-4-2109(b)(2)(C).

Enhancement County

Adventure Tourism Zone

(c) Additional Annual Job Tax Credit for Higher Level of Investments – Tenn. Code Ann. § 67-4-2109(b)(2)(B)

(i)

$1,000,000,000 investment with at least 500 new industrial wage jobs

(ii)

$500,000,000 investment with at least 500 new industrial wage jobs

(iii)

$250,000,000 investment with at least 250 new industrial wage jobs

(iv)

$100,000,000 investment with at least 100 new industrial wage jobs

(v) Integrated Supplier or Integrated Customer located in the footprint of a taxpayer making $1,000,000,000 investment

with at least 500 new industrial wage jobs

(vi) Headquarters facility with a $10,000,000 investment and at least 100 new headquarters staff employees

The statements made on this business plan are true to the best of my

knowledge and belief. (Must be signed by the taxpayer.)

SIGN HERE:

Control No.

Signature and Date

Title

Phone No.

FOR DEPARTMENT OF REVENUE USE ONLY

RV-F1308601 (Rev. 6-12)

1

1 2

2