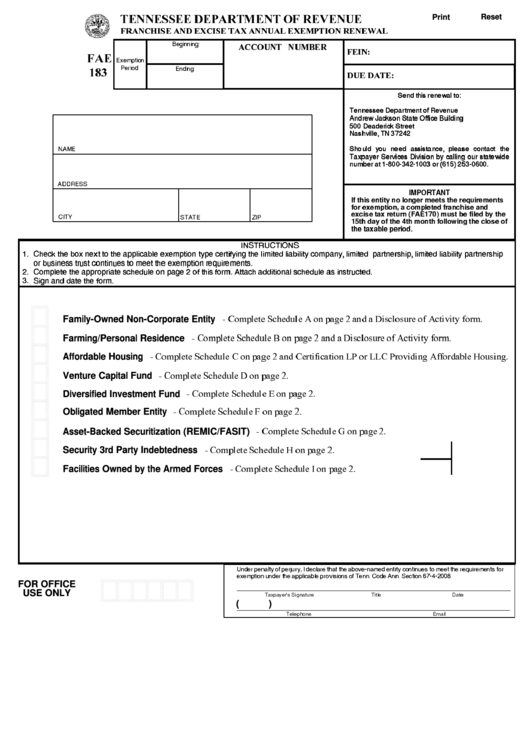

TENNESSEE DEPARTMENT OF REVENUE

Print

Reset

FRANCHISE AND EXCISE TAX ANNUAL EXEMPTION RENEWAL

ACCOUNT NUMBER

Beginning:

FEIN:

FAE

Exemption

183

Period

Ending:

DUE DATE:

Send this renewal to:

Tennessee Department of Revenue

Andrew Jackson State Office Building

500 Deaderick Street

Nashville, TN 37242

Should you need assistance, please contact the

NAME

Taxpayer Services Division by calling our statewide

number at 1-800-342-1003 or (615) 253-0600.

ADDRESS

IMPORTANT

If this entity no longer meets the requirements

for exemption, a completed franchise and

excise tax return (FAE170) must be filed by the

CITY

ZIP

STATE

15th day of the 4th month following the close of

the taxable period.

INSTRUCTIONS

1.

Check the box next to the applicable exemption type certifying the limited liability company, limited partnership, limited liability partnership

or business trust continues to meet the exemption requirements.

2.

Complete the appropriate schedule on page 2 of this form. Attach additional schedule as instructed.

3.

Sign and date the form.

MN

- Complete Schedule A on page 2 and a Disclosure of Activity form.

Family-Owned Non-Corporate Entity

HI

- Complete Schedule B on page 2 and a Disclosure of Activity form.

Farming/Personal Residence

HI

- Complete Schedule C on page 2 and Certification LP or LLC Providing Affordable Housing.

Affordable Housing

HI

- Complete Schedule D on page 2.

Venture Capital Fund

HI

- Complete Schedule E on page 2.

Diversified Investment Fund

HI

- Complete Schedule F on page 2.

Obligated Member Entity

HI

- Complete Schedule G on page 2.

Asset-Backed Securitization (REMIC/FASIT)

HI

- Complete Schedule H on page 2.

Security 3rd Party Indebtedness

HI

- Complete Schedule I on page 2.

Facilities Owned by the Armed Forces

Under penalty of perjury, I declare that the above-named entity continues to meet the requirements for

exemption under the applicable provisions of Tenn. Code Ann. Section 67-4-2008.

MMMMMMN

FOR OFFICE

USE ONLY

Taxpayer�s Signature

Title

Date

(

)

Telephone

Email

1

1 2

2