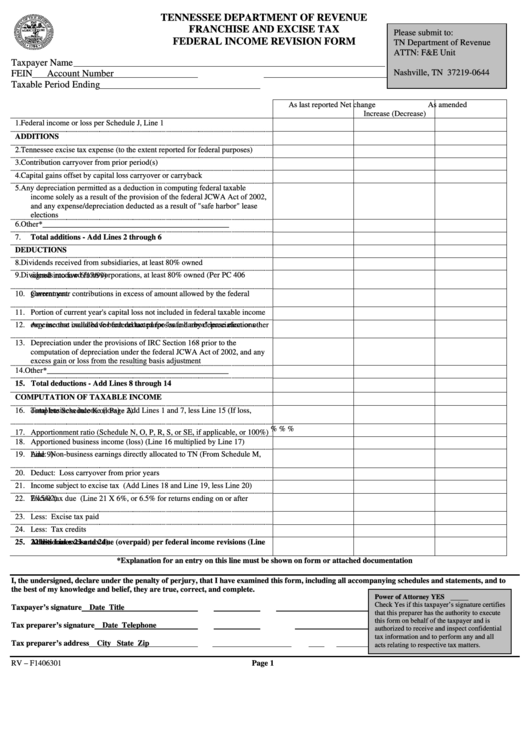

TENNESSEE DEPARTMENT OF REVENUE

FRANCHISE AND EXCISE TAX

Please submit to:

FEDERAL INCOME REVISION FORM

TN Department of Revenue

ATTN: F&E Unit

Taxpayer Name

P.O. Box 190644

Nashville, TN 37219-0644

FEIN

Account Number

Taxable Period Ending

As last reported

Net change

As amended

Increase (Decrease)

1.

Federal income or loss per Schedule J, Line 1

ADDITIONS

2.

Tennessee excise tax expense (to the extent reported for federal purposes)

3.

Contribution carryover from prior period(s)

4.

Capital gains offset by capital loss carryover or carryback

5.

Any depreciation permitted as a deduction in computing federal taxable

income solely as a result of the provision of the federal JCWA Act of 2002,

and any expense/depreciation deducted as a result of "safe harbor" lease

elections

6.

Other*________________________________________________

7.

Total additions - Add Lines 2 through 6

DEDUCTIONS

8.

Dividends received from subsidiaries, at least 80% owned

9.

Dividends received from corporations, at least 80% owned (Per PC 406

signed into law 6/17/99)

10. Current year contributions in excess of amount allowed by the federal

government

11. Portion of current year's capital loss not included in federal taxable income

12. Any income included for federal tax purposes and any depreciation or other

expense that could have been deducted for "safe harbor" lease elections

13. Depreciation under the provisions of IRC Section 168 prior to the

computation of depreciation under the federal JCWA Act of 2002, and any

excess gain or loss from the resulting basis adjustment

14. Other*______________________________________________

15. Total deductions - Add Lines 8 through 14

COMPUTATION OF TAXABLE INCOME

16. Total business income (loss) - Add Lines 1 and 7, less Line 15 (If loss,

complete Schedule K on Page 2)

%

%

%

17. Apportionment ratio (Schedule N, O, P, R, S, or SE, if applicable, or 100%)

18. Apportioned business income (loss) (Line 16 multiplied by Line 17)

19. Add: Non-business earnings directly allocated to TN (From Schedule M,

Line 9)

20. Deduct: Loss carryover from prior years

21. Income subject to excise tax (Add Lines 18 and Line 19, less Line 20)

22. Excise tax due (Line 21 X 6%, or 6.5% for returns ending on or after

7/15/02)

23. Less: Excise tax paid

24. Less: Tax credits

25. Additional excise tax due (overpaid) per federal income revisions (Line

22 less Lines 23 and 24)

*Explanation for an entry on this line must be shown on form or attached documentation

I, the undersigned, declare under the penalty of perjury, that I have examined this form, including all accompanying schedules and statements, and to

the best of my knowledge and belief, they are true, correct, and complete.

Power of Attorney

YES

Check Yes if this taxpayer’s signature certifies

Taxpayer’s signature

Date

Title

that this preparer has the authority to execute

this form on behalf of the taxpayer and is

Tax preparer’s signature

Date

Telephone

authorized to receive and inspect confidential

tax information and to perform any and all

Tax preparer’s address

City

State

Zip

acts relating to respective tax matters.

RV – F1406301

Page 1

1

1 2

2