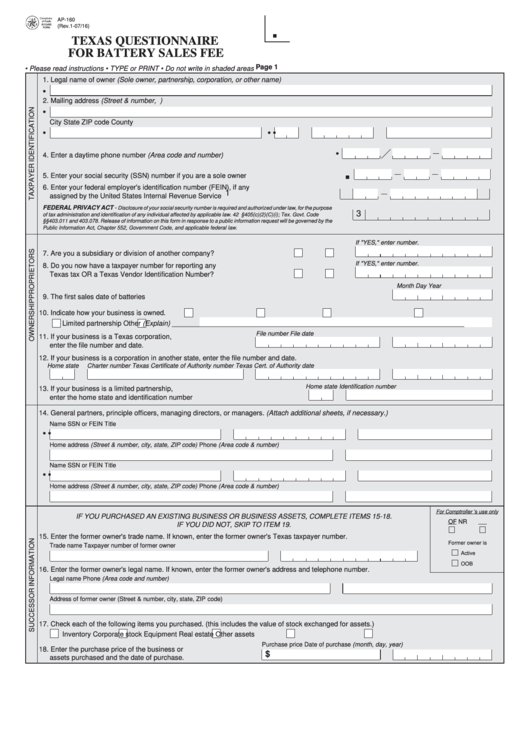

AP-160

(Rev.1-07/16)

TEXAS QUESTIONNAIRE

CLEAR FORM

PRINT

FOR BATTERY SALES FEE

Page 1

• Please read instructions

• TYPE or PRINT

• Do not write in shaded areas

1. Legal name of owner (Sole owner, partnership, corporation, or other name)

•

2. Mailing address (Street & number, P.O. Box or rural route and box number)

•

City

State

ZIP code

County

•

•

•

•

4. Enter a daytime phone number (Area code and number) .....................

5. Enter your social security (SSN) number if you are a sole owner ................................................

6. Enter your federal employer's identification number (FEIN), if any

1

assigned by the United States Internal Revenue Service .........................................................

FEDERAL PRIVACY ACT -

Disclosure of your social security number is required and authorized under law, for the purpose

3

of tax administration and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code

§§403.011 and 403.078. Release of information on this form in response to a public information request will be governed by the

Public Information Act, Chapter 552, Government Code, and applicable federal law.

If "YES," enter number.

7. Are you a subsidiary or division of another company? .......................................

YES

NO

If "YES," enter number.

8. Do you now have a taxpayer number for reporting any

Texas tax OR a Texas Vendor Identification Number? ......................................

YES

NO

Month

Day

Year

9. The first sales date of batteries .............................................................................................................................

10. Indicate how your business is owned. ......

Sole owner

Partnership

Texas corporation

Foreign corporation

Limited partnership

Other (Explain) ___________________________________________________________________________

File number

File date

11. If your business is a Texas corporation,

enter the file number and date. .....................................................

12. If your business is a corporation in another state, enter the file number and date.

Home state

Charter number

Texas Certificate of Authority number

Texas Cert. of Authority date

Home state

Identification number

13. If your business is a limited partnership,

enter the home state and identification number ........................................................

14. General partners, principle officers, managing directors, or managers. (Attach additional sheets, if necessary.)

Name

SSN or FEIN

Title

•

•

Home address (Street & number, city, state, ZIP code)

Phone (Area code & number)

Name

SSN or FEIN

Title

•

•

Home address (Street & number, city, state, ZIP code)

Phone (Area code & number)

For Comptroller 's use only

IF YOU PURCHASED AN EXISTING BUSINESS OR BUSINESS ASSETS, COMPLETE ITEMS 15-18.

OF

NR

IF YOU DID NOT, SKIP TO ITEM 19.

15. Enter the former owner's trade name. If known, enter the former owner's Texas taxpayer number.

Former owner is

Trade name

Taxpayer number of former owner

Active

OOB

16. Enter the former owner's legal name. If known, enter the former owner's address and telephone number.

Legal name

Phone (Area code and number)

Address of former owner (Street & number, city, state, ZIP code)

17. Check each of the following items you purchased. (this includes the value of stock exchanged for assets.)

Inventory

Corporate stock

Equipment

Real estate

Other assets

Purchase price

Date of purchase (month, day, year)

18. Enter the purchase price of the business or

$

assets purchased and the date of purchase. .....................................

1

1 2

2