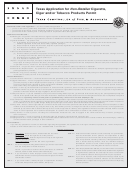

AP-175-4

(Rev.2-13/15)

Texas Application for Non-Retailer

Cigarette, Cigar and/or

• Type or print.

• Do NOT write in shaded areas.

Tobacco Products Permit

Page 3

29. Legal name of owner (same as Item 1)

•

f you purchased an existing business or business assets, complete Items 30-33; otherwise, skip to Item 34.

I

30. Enter the former owner's trade name. If known, enter the former owner's Texas taxpayer number.

Trade name

Taxpayer number of former owner

OF

NR

31. Enter the former owner's legal name. If known, enter the former owner's telephone number.

Legal name of former owner

Phone (area code and number)

Former owner is

Active

Address of former owner (street and number, city, state, ZIP code)

OOB

32. Check each of the following items you purchased. (This includes the value of stock exchanged for assets.)

Inventory

Corporate stock

Equipment

Real estate

Other assets

33. Enter the purchase price of the business or assets purchased and the date of purchase.

Purchase price

Date of purchase (month, day, year)

The sole owner, all general partners, corporation president, vice-president, secretary or treasurer, or an

Date of application (month, day, year)

authorized representative must sign this application. Representative must submit a written power of attorney

with application. (Attach additional sheets, if necessary.)

34. I (We) declare that the information in this document and any attachments is true and correct to the best of my (our) knowledge and belief.

Type or print name and title of sole owner, partner or officer

Sole owner, partner or officer

Type or print name and title of partner or officer

Partner or officer

Type or print name and title of partner or officer

Partner or officer

Your permit must be prominently displayed in your place of business.

All information provided on this form may be disclosed to the public, upon request, under the

Texas Public Information Act, Government Code, Chapter 552.

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental

entity to conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is

available online at You may also want to contact the municipality and county in which you will conduct

business to determine any local governmental requirements.

Non-Retailer Permit Fees

(Cigarette and/or Tobacco Products Permits expire the last day of February each year.)

PERMIT TYPE

ANN. FEE

MAR.

APR.

MAY

JUNE

JULY

AUG.

SEPT.

OCT.

NOV.

DEC.*

JAN.*

FEB.*

Bonded agent

$300.00

$300.00

$275.00

$250.00

$225.00

$200.00

$175.00

$150.00

$125.00

$100.00

$75.00

$50.00

$25.00

Distributor

300.00

300.00

275.00

250.00

225.00

200.00

175.00

150.00

125.00

100.00

75.00

50.00

25.00

Manufacturer

300.00

300.00

275.00

250.00

225.00

200.00

175.00

150.00

125.00

100.00

75.00

50.00

25.00

Wholesaler

200.00

200.00

183.33

166.67

150.00

133.33

116.67

100.00

83.33

66.67

50.00

33.33

16.67

Vehicle

15.00

15.00

13.75

12.50

11.25

10.00

8.75

7.50

6.25

5.00

3.75

2.50

1.25

Importer

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

A vehicle permit can only be purchased in addition to a Distributor, Manufacturer or Wholesaler permit. The vehicle permit fees listed above reflect the amount due per vehicle.

* During the last three months of the permit period, the Comptroller may collect the prorated fee for the current period and the fee for the next period. Add the amount in the

"Annual Fee" column to the prorated amount for the applicable month. (i.e., January fee is $50.00 + annual fee of $300.00 = $350.00.)

A $50 late fee will be assessed on each existing location that is not in compliance with permit requirements. Tex. Tax Code Ann. Ch. 154 and/or Ch. 155.

Mail your completed application with the required permit fee to:

Make check payable to:

Comptroller of Public Accounts

State Comptroller

111 E. 17th St.

Austin, TX 78774-0100

1

1 2

2 3

3 4

4