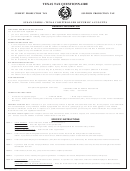

AP-171-2

(Rev.1-07/5)

TEXAS TAX QUESTIONNAIRE

Page 1.

• PLEASE READ INSTRUCTIONS

• TYPE OR PRINT

• DO NOT WRITE IN SHADED AREAS

CHECK THE TAX TYPE FOR WHICH

CEMENT PRODUCTION

SULPHUR PRODUCTION

YOU WILL BE RESPONSIBLE

For Comptroller's use only

1.

Legal name of owner (Sole owner, partnership, corporation or other name)

•

FEEAPP

Job name:

2.

Mailing address (Street & number, P.O. Box or rural route and box number)

00991

•

Tax type / reason

City

State

ZIP Code

County

2

0

•

•

•

Reference number

Area code

Number

3. Enter the daytime phone number of the person

•

primarily responsible for filing tax returns .......................................

Master name change

01170

2

FALCON

4. Enter your Social Security Number if you are a sole owner ................

0 - Send

5. Enter your Federal Employer's Identification (FEI)

1 - Do not send

1

Number, if any ................................................................................

Master account set-up

3

01100

FALCON

Master mailing address

change

01180

FALCON

6. Are you a subsidiary or division

If, "YES," enter

YES

NO

of another company?

number ................

County code

7. Do you now have a taxpayer number for

reporting any Texas tax OR aTexas

If, "YES," enter

YES

NO

Vendor Identification Number?

number ................

Master phone number

add/change

8. Enter the date of your first cement/sulphur production (Month, day, year) ............................

01185

FALCON

Secondary mailing

9. Indicate how your business is owned.

1 - Sole owner

2 - Partnership

3 - Texas corporation

address set-up

7 - Limited partnership

6 - Foreign corporation

4 - Other (explain)

02720

FALCON

Charter number

Charter date

10. If your business is a Texas corporation, enter the charter

number and date ........................................................

Ownership type

11. If your business is a foreign corporation, enter home state, charter number, Texas Certificate of Authority number & date.

Home state

Charter number

Texas Cert. of Auth. number

Texas Cert. of Auth. date

0 0 0 0

Home state

Identification number

12. If your business is a limited partnership, enter the home

Tax type

state and identification number ..................................

0

County code

13. List all general partners or principal officers of your business. (Attach additional sheets if necessary)

If you are a sole owner, skip Item 13.

Partnership set-up

Social Security or Federal Identification (FEI) Number

Title

Name (First, middle initial, last)

01140

FALCON

•

•

XASETT

Phone (Area code & no.)

Home address (Street & number, city, state, ZIP Code)

Set up

Cement Production

Social Security or Federal Identification (FEI) Number

Title

Name (First, middle initial, last)

Sulphur production

•

•

Effective date

Phone (Area code & no.)

Home address (Street & number, city, state, ZIP Code)

mm

dd

yyyy

•

Title

Name (First, middle initial, last)

Social Security or Federal Identification (FEI) Number

•

•

Phone (Area code & no.)

Vendor hold

Home address (Street & number, city, state, ZIP Code)

0 - YES

•

1 - NO

Title

Social Security or Federal Identification (FEI) Number

Name (First, middle initial, last)

•

•

Included in audit

Phone (Area code & no.)

Home address (Street & number, city, state, ZIP Code)

0 - YES

1 - NO

•

1

1 2

2 3

3