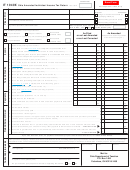

IT 1040X

Rev. 6/11

Reason and Explanation of Corrections

Please attach documentation to support any adjustments to line items. Refer to the chart on page 4 of the

instructions to identify required documentation for complete processing of the amended return.

Taxpayer name

Social Security number

Year

Reason(s):

Net operating loss carryback (IMPORTANT: Be sure to

Joint fi ling credit increased

complete and attach Ohio form IT NOL, Net Operating Loss

Joint fi ling credit decreased

Carryback Worksheet and check the box on the front of this

Ohio use tax increased

return indicating you are amending for an NOL.)

Ohio use tax decreased

Federal adjusted gross income decreased

Ohio form IT/SD 2210 interest penalty amount increased

Federal adjusted gross income increased

Ohio form IT/SD 2210 interest penalty amount decreased

Filing status changed

Manufacturing grant increased

Residency status changed

Manufacturing grant decreased

Exemptions increased

Refundable business credits increased

Exemptions decreased

Refundable business credits decreased

Ohio form IT 1040, Schedule A, additions to income

Ohio withholding increased

Ohio form IT 1040, Schedule A, deductions from income

Ohio withholding decreased

Ohio form IT 1040, Schedule B, credit increased

Estimated and/or Ohio form IT 40P amount or previous year

Ohio form IT 1040, Schedule B, credit decreased

carryforward overpayment increased

Ohio form IT 1040, Schedule C, credit increased

Estimated and/or Ohio form IT 40P amount or previous year

Ohio form IT 1040, Schedule C, credit decreased

carryforward overpayment decreased

Ohio form IT 1040, Schedule D, credit increased

Amount paid with original fi ling did not equal amount reported

Ohio form IT 1040, Schedule D, credit decreased

as paid with the original fi ling

Ohio form IT 1040, Schedule E, credit increased

Ohio form IT 1040, Schedule E, credit decreased

Detailed explanation of adjusted items (attach additional sheet(s) if necessary):

E-mail address (optional)

Telephone number (optional)

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of

1974 requires us to inform you that providing us with your Social Security number is mandatory.

Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this informa-

tion. We need your Social Security number in order to administer this tax.

- 2 -

1

1 2

2 3

3 4

4 5

5