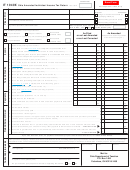

IT 1040X

Rev. 6/11

to $450,000 (the amount of the year 2006 federal modifi ed taxable

Line 6 – To calculate the amounts you will show on this amended

income). Maria can use the remaining $300,000 of the year 2008

return, use the Ohio form IT 1040 instruction booklet for the year

NOL carryback/carryforward for taxable years 2007 and later.

you show on the front of this form.

Line 23 – Enter on this line all of the following:

Reason and Explanation of Corrections

Be sure to complete and attach page 2 of this return.

Refunds you claimed on previously fi led returns for the year

shown on this form – even if you have not yet received the

Nonresident Married Filing Jointly Taxpayers

refund;

As a general rule, if your fi ling status on your federal income tax

Donations you made on your previously fi led return; AND

return is “married fi ling jointly,” then both spouses must sign the Ohio

Amounts you previously claimed as an overpayment credit to

income tax return. There is only one exception, discussed below, to

the next year (see "Special Rule for Overpayments" below).

the general rule requiring both spouses to sign the “married fi ling

jointly” Ohio income tax return.

Reduce the amount on this line by the interest penalty and interest

and penalty shown on your originally fi led return.

Exception to the General Rule. Your spouse does not have to

sign an amended "married fi ling jointly" return only if all three of

Special Rule for Overpayments

the following apply:

(Line 23 on Ohio Form IT 1040X)

If you want to reduce the amount of your overpayment credit to be

Your spouse resided outside Ohio for the entire year;

applied to the following year, as shown on the originally fi led return

Your spouse did not earn any income in Ohio; AND

for the year you are amending, you must do both of the following:

Your spouse did not receive any income in Ohio.

Include on line 23 only the amount of the overpayment credit

See Ohio Administrative Code Rule 5703-7-18 available through

that you claimed on your originally fi led return and that you

our Web site at tax.ohio.gov.

now want applied to the following year; AND

You may need to enclose additional forms and documentation.

Amend the following year's return (if already fi led) to show

Please see chart below.

the reduction in the amount of the overpayment credit being

applied on that return.

Line Instructions

Ohio public school district number – See the listing in the instruc-

Line 25 – This line must include the amount of interest you owe.

tions for Ohio form IT 1040.

For a schedule of yearly interest rates, go to tax.ohio.gov, click on

"Tax Professionals" and then click on "Interest Rates."

Additional Forms and Documentation

If you are

changing the

Then include the following forms or document:

amount on this line:

Line 2

Ohio Schedule A, as amended

(click here for the 2011 Schedule A)

Line 7

Ohio Schedule B, as amended

(click here for the 2011 Schedule B)

Line 13

Ohio Schedule C, D and/or E, as amended – see Ohio form IT 1040 instructions for information concerning

required enclosures. If you are changing the amount of the resident credit, you must include a copy of

the other state's or states' income tax return. If you are changing the amount of the nonresident credit,

you must complete and include Ohio form IT 2023, as amended.

(click here for the 2011 Schedule C)

(click here for the 2011 Schedule D)

(click here for the 2011 Schedule E)

Line 15

Ohio form IT/SD 2210 as amended

(click here for the 2011 IT/SD 2210)

Line 18

W-2 forms or 1099 forms showing correct Ohio income tax withheld.

Line 20

See Ohio form IT 1040 instructions for information concerning required enclosures.

Mail to: Ohio Department of Taxation, P.O. Box 1460, Columbus, OH 43216-1460. Phone: 1-800-282-1780

- 4 -

1

1 2

2 3

3 4

4 5

5