• Interest income on trade receivables or installment

Line 8. Add: Gains from prior year installment sales

apportioned to Oregon. Multiply the installment gains

contracts arising out of the business or from the invest-

subtracted on line 3 by the average percent from the year

ment of working capital.

of the sale.

“Nonbusiness income” means all income other than

Line 10. Net loss and net capital loss deduction. Do not

business income. Rents, royalties, gains or losses, and

use line 10 when computing Oregon-source distributive

interest also can be nonbusiness income if they arise

income for nonresident owners of PTEs.

from investments not related to the taxpayer’s busi-

Note: If you are claiming the Oregon investment advan-

ness. Nonbusiness income is allocated to a particular

tage subtraction allowed under ORS 317.391, include the

state based upon the source of the income. Gain or loss

amount of exempt certified facility income on line 10b.

from the sale of a partnership interest may be allocable

Attach a schedule showing your computations.

to Oregon [ORS 314.635(4)]. A schedule of nonbusiness

income must be attached to the return. The amounts

Line 11. Carry this amount to the appropriate line on

your tax return: Form 20, line 15; Form 20-I, line 16; Form

allocable to Oregon must be added to Oregon’s appor-

20-S, line 6; or Form 20-INS, line 21. For nonresident

tioned income. See ORS 314.610 and administrative rules.

owners of PTEs, this line results in Oregon-source dis-

Line 3. Subtract: Gains from prior year installment

tributive income. Report each nonresident owner’s and

sales included in line 1. OAR 150-314.615-(G) requires

corporate owner’s share on their information return,

that installment gains be apportioned to Oregon using

along with the Oregon-source portion of (1) any guar-

the average percent from the year of the sale rather than

anteed payments (for partnerships) and (2) the taxable

the year payment is received.

portion of distributions.

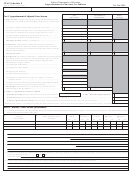

AP Worksheets (Oregon apportionment percentage)

These worksheets are for businesses having business activities both inside and outside of Oregon. If the entity’s

business activities are all within Oregon, do not use these worksheets.

Standard apportionment worksheet

Business income is apportioned to Oregon by multiplying the income by a multiplier equal to Oregon sales and other receipts

as determined by Schedule AP-1, divided by total sales and other receipts from the federal return. See ORS 314.650.

(a)

(b)

(c) = (a ÷ b) x 100

1. Total sales and other receipts (Schedule AP-1, line 21) ....................................... 1

2. Oregon apportionment percentage (enter on Schedule AP-1, line 22) ............................................................................. 2

%

Alternative apportionment worksheet

(double-weighted sales factor formula) for utility or telecommunication

taxpayers

Taxpayers primarily engaged in utilities or telecommunications may elect to apportion business income using the double-

weighted sales factor provided in ORS 314.650 (1999 edition).

Check the box on front of your return if you’re using the alternative apportionment worksheet (Form 20, question M; Form

20-I, question L; Form 20-S, question J). All others use the standard apportionment worksheet above.

(a)

(b)

(c) = (a ÷ b) x 100

%

1. Total owned and rented property (Schedule AP-1, line 9) ................................... 1

%

2. Total wages and salaries (Schedule AP-1, line 12) .............................................. 2

%

3. Total sales and other receipts (Schedule AP-1, line 21) ....................................... 3

%

4. Total sales and other receipts (same as line 3 above).......................................... 4

%

5. Total percent (add lines 1-4, column c above) ...................................................................................................................... 5

6. Number of factors with a positive number in column b ........................................................................................................ 6

%

7. Alternative apportionment percentage (divide line 5 by line 6; enter on Schedule AP-1, line 22) .................................... 7

3

150-102-171 (Rev. 10-11)

Schedule AP instructions

1

1 2

2 3

3 4

4