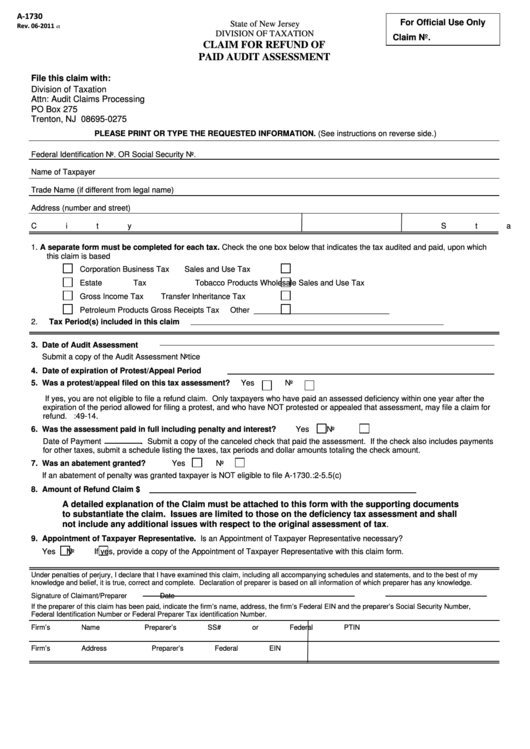

A‐1730

For Official Use Only

State of New Jersey

Rev. 06‐2011

ct

DIVISION OF TAXATION

Claim No.

CLAIM FOR REFUND OF

PAID AUDIT ASSESSMENT

File this claim with:

Division of Taxation

Attn: Audit Claims Processing

PO Box 275

Trenton, NJ 08695-0275

PLEASE PRINT OR TYPE THE REQUESTED INFORMATION. (See instructions on reverse side.)

Federal Identification No. OR Social Security No.

Name of Taxpayer

Trade Name (if different from legal name)

Address (number and street)

City

State

Zip Code

1.

A separate form must be completed for each tax. Check the one box below that indicates the tax audited and paid, upon which

this claim is based

Corporation Business Tax

Sales and Use Tax

Estate Tax

Tobacco Products Wholesale Sales and Use Tax

Gross Income Tax

Transfer Inheritance Tax

Petroleum Products Gross Receipts Tax

Other _______________________________

2.

Tax Period(s) included in this claim

3. Date of Audit Assessment

Submit a copy of the Audit Assessment Notice

4. Date of expiration of Protest/Appeal Period

5. Was a protest/appeal filed on this tax assessment?

Yes

No

If yes, you are not eligible to file a refund claim. Only taxpayers who have paid an assessed deficiency within one year after the

expiration of the period allowed for filing a protest, and who have NOT protested or appealed that assessment, may file a claim for

refund. N.J.S.A. 54:49-14.

6. Was the assessment paid in full including penalty and interest?

Yes

No

Date of Payment

. Submit a copy of the canceled check that paid the assessment. If the check also includes payments

for other taxes, submit a schedule listing the taxes, tax periods and dollar amounts totaling the check amount.

7. Was an abatement granted?

Yes

No

If an abatement of penalty was granted taxpayer is NOT eligible to file A-1730. N.J.A.C. 18:2-5.5(c)1.ii

8. Amount of Refund Claim $

A detailed explanation of the Claim must be attached to this form with the supporting documents

to substantiate the claim. Issues are limited to those on the deficiency tax assessment and shall

not include any additional issues with respect to the original assessment of tax.

9. Appointment of Taxpayer Representative. Is an Appointment of Taxpayer Representative necessary?

Yes

No

If yes, provide a copy of the Appointment of Taxpayer Representative with this claim form.

Under penalties of perjury, I declare that I have examined this claim, including all accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete. Declaration of preparer is based on all information of which preparer has any knowledge.

Signature of Claimant/Preparer

Date

If the preparer of this claim has been paid, indicate the firm’s name, address, the firm’s Federal EIN and the preparer’s Social Security Number,

Federal Identification Number or Federal Preparer Tax identification Number.

Firm’s Name

Preparer’s SS# or Federal PTIN

Firm’s Address

Preparer’s Federal EIN

1

1 2

2