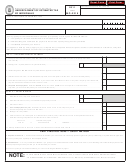

INSTRUCTIONS — IA 2210S

A. Purpose of This Form:

If you are an individual taxpayer other than a qualifying farmer or fisher, you may be able to use this form

to determine whether your income tax was sufficiently paid throughout the year by withholding or by

estimated payments. If not, you may owe a penalty.

B. How to Avoid Underpayment Penalty:

Taxpayers may avoid underpayment penalty if their estimated payments for 2011, made on or before the

required dates for payment, plus Iowa tax withheld for 2011, are equal to the lesser of:

(1) 90 % of the tax shown on the 2011 return; or

(2) 100% of the tax shown on the 2010 return if their 2010 federal AGI is $150,000 ($75,000 for

married filing separate federal returns) or less; or

(3) 110% of the tax shown on the 2010 return if their 2010 federal AGI is greater than $150,000

($75,000 for married filing separate federal returns) plus any bonus depreciation adjustment.

The taxpayer’s 2010 return must have covered a period of 12 months.

C. Filing an Estimate and Paying the Tax, Calendar Year Taxpayers:

The form IA 1040ES is used to estimate and mail your quarterly tax payments. Estimated tax payments are due

on the last day of April, June, and September of 2011, and final payment by January 31, 2012.

NOTE: If any date shown falls on a weekend, federal holiday, or legal holiday as defined in Iowa Code section

4.1(34), substitute the next regular working day.

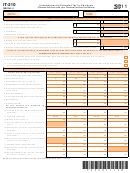

LINE INSTRUCTIONS

Line 8 - If the total from line 8 is less than $200, STOP; you do not owe 2210 penalty. If line 8 is $200 or

more, continue to line 9.

Line 9 - Multiply the amount on line 8 by 0.033177. If full payment was made on or after April 30, 2012,

this is your IA 2210S penalty to be entered on line 73 of the IA 1040.

Line 10 - If full payment was made before April 30, 2012, enter the smaller of the amount on line 8 or the

amount of estimated taxes paid. Complete lines 11 through 14 to determine your IA 2210S penalty to be

entered on line 73 of the IA 1040.

Waiver of Penalty: The underpayment of estimated tax penalty may be waived if the underpayment was

due to casualty, disaster, or other unusual circumstances. The penalty may also be waived if the taxpayer

retired at age 62 or later, or became disabled in the tax year for which the estimated payments were

required, and such underpayment was due to reasonable cause and not to willful neglect.

Farmers and Fishers: If two-thirds of your gross income is received from farming or fishing, different rules

apply. See the instructions for the IA 2210F form.

45-012b (01/13/12)

1

1 2

2