Reset Form

Print Form

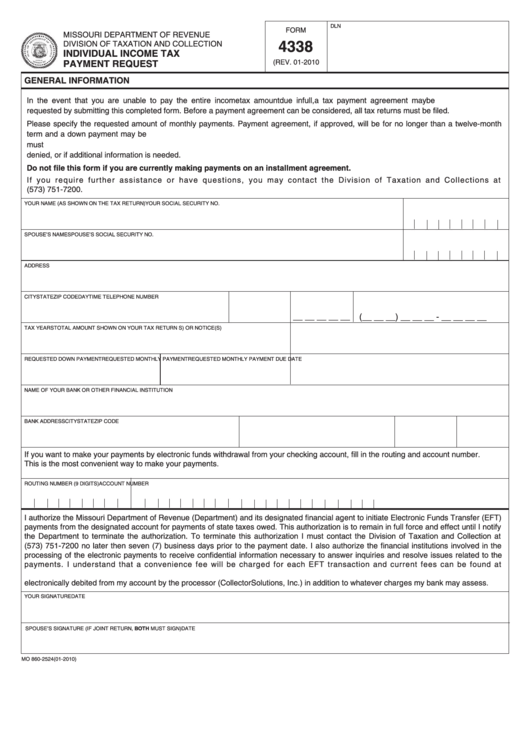

DLN

FORM

MISSOURI DEPARTMENT OF REVENUE

4338

DIVISION OF TAXATION AND COLLECTION

INDIVIDUAL INCOME TAX

(REV. 01-2010

PAYMENT REQUEST

GENERAL INFORMATION

In the event that you are unable to pay the entire income tax amount due in full, a tax payment agreement may be

requested by submitting this completed form. Before a payment agreement can be considered, all tax returns must be filed.

Please specify the requested amount of monthly payments. Payment agreement, if approved, will be for no longer than a twelve-month

term and a down payment may be required. We encourage you to make your payments as large as possible to reduce the interest you

must pay. Please attach this form to the front of your tax return. Our office will notify you within 90 days if your request was approved or

denied, or if additional information is needed.

Do not file this form if you are currently making payments on an installment agreement.

If you require further assistance or have questions, you may contact the Division of Taxation and Collections at

(573) 751-7200.

YOUR NAME (AS SHOWN ON THE TAX RETURN)

YOUR SOCIAL SECURITY NO.

SPOUSE’S NAME

SPOUSE’S SOCIAL SECURITY NO.

ADDRESS

CITY

STATE

ZIP CODE

DAYTIME TELEPHONE NUMBER

__ __ __ __ __

(__ __ __) __ __ __ - __ __ __ __

TAX YEARS

TOTAL AMOUNT SHOWN ON YOUR TAX RETURN S) OR NOTICE(S)

REQUESTED DOWN PAYMENT

REQUESTED MONTHLY PAYMENT

REQUESTED MONTHLY PAYMENT DUE DATE

NAME OF YOUR BANK OR OTHER FINANCIAL INSTITUTION

BANK ADDRESS

CITY

STATE

ZIP CODE

If you want to make your payments by electronic funds withdrawal from your checking account, fill in the routing and account number.

This is the most convenient way to make your payments.

ROUTING NUMBER (9 DIGITS)

ACCOUNT NUMBER

I authorize the Missouri Department of Revenue (Department) and its designated financial agent to initiate Electronic Funds Transfer (EFT)

payments from the designated account for payments of state taxes owed. This authorization is to remain in full force and effect until I notify

the Department to terminate the authorization. To terminate this authorization I must contact the Division of Taxation and Collection at

(573) 751-7200 no later then seven (7) business days prior to the payment date. I also authorize the financial institutions involved in the

processing of the electronic payments to receive confidential information necessary to answer inquiries and resolve issues related to the

payments. I understand that a convenience fee will be charged for each EFT transaction and current fees can be found at

I understand in the event that my bank returns a payment due to insufficient funds an additional charge will be

electronically debited from my account by the processor (CollectorSolutions, Inc.) in addition to whatever charges my bank may assess.

YOUR SIGNATURE

DATE

SPOUSE’S SIGNATURE (IF JOINT RETURN, BOTH MUST SIGN)

DATE

MO 860-2524 (01-2010)

1

1