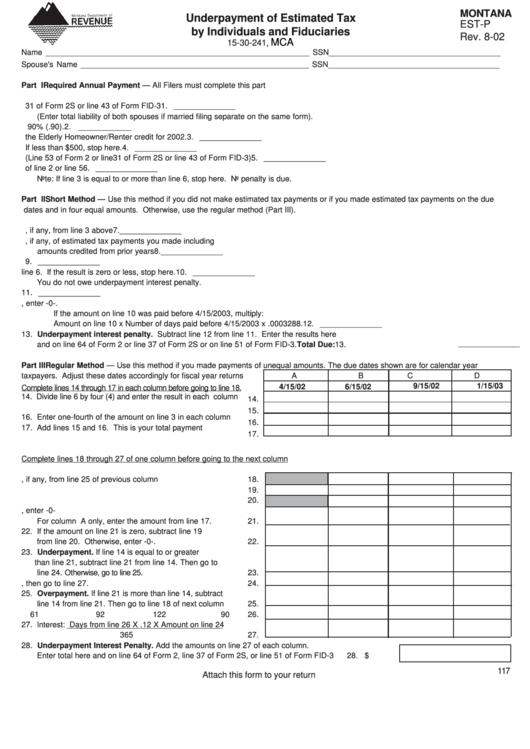

Montana Form Est-P - Underpayment Of Estimated Tax By Individuals And Fiduciaries - 2002

ADVERTISEMENT

MONTANA

Underpayment of Estimated Tax

EST-P

by Individuals and Fiduciaries

Rev. 8-02

MCA

15-30-241,

Name ____________________________________________________________ SSN_______________________________________

Spouse's Name ____________________________________________________ SSN_______________________________________

Part I Required Annual Payment — All Filers must complete this part

1. Enter 2002 tax from line 53 of Form 2 or line 31 of Form 2S or line 43 of Form FID-3

1. ______________

(Enter total liability of both spouses if married filing separate on the same form).

2. Multiply line 1 by 90% (.90).

2. ____________

3. Enter Montana tax withheld and/or the Elderly Homeowner/Renter credit for 2002.

3. ______________

4. Subtract line 3 from line 1. If less than $500, stop here.

4. ______________

5. Enter 2001 tax (Line 53 of Form 2 or line 31 of Form 2S or line 43 of Form FID-3)

5. ______________

6. Required annual payment. Enter the smaller of line 2 or line 5

6. ______________

Note: If line 3 is equal to or more than line 6, stop here. No penalty is due.

Part II Short Method — Use this method if you did not make estimated tax payments or if you made estimated tax payments on the due

dates and in four equal amounts. Otherwise, use the regular method (Part III).

7. Enter the amount, if any, from line 3 above

7.______________

8. Enter the total amount, if any, of estimated tax payments you made including

amounts credited from prior years

8.______________

9. Add lines 7 and 8

9. ______________

10. Total underpayment for year. Subtract line 9 from line 6. If the result is zero or less, stop here.

10. ______________

You do not owe underpayment interest penalty.

11. Multiply line 10 by .07980 and enter the result

11. ______________

12.

If the amount on line 10 was paid on or after 4/15/2003, enter -0-.

If the amount on line 10 was paid before 4/15/2003, multiply:

Amount on line 10 x Number of days paid before 4/15/2003 x .0003288.

12. ______________

13. Underpayment interest penalty. Subtract line 12 from line 11. Enter the results here

and on line 64 of Form 2 or line 37 of Form 2S or on line 51 of Form FID-3.

Total Due: 13.

Part III Regular Method — Use this method if you made payments of unequal amounts. The due dates shown are for calendar year

taxpayers. Adjust these dates accordingly for fiscal year returns

A

B

C

D

9/15/02

1/15/03

4/15/02

6/15/02

Complete lines 14 through 17 in each column before going to line 18.

14. Divide line 6 by four (4) and enter the result in each column

14.

15. Enter amount of estimated tax paid on each date

15.

16. Enter one-fourth of the amount on line 3 in each column

16.

17. Add lines 15 and 16. This is your total payment

17.

Complete lines 18 through 27 of one column before going to the next column

18. Enter amount, if any, from line 25 of previous column

18.

19. Add lines 17 and 18

19.

20. Enter amount on line 24 of the previous column

20.

21. Subtract line 20 from line 19. If zero or less, enter -0-

For column A only, enter the amount from line 17.

21.

22. If the amount on line 21 is zero, subtract line 19

from line 20. Otherwise, enter -0-.

22.

23. Underpayment. If line 14 is equal to or greater

than line 21, subtract line 21 from line 14. Then go to

line 24. Otherwise, go to line 25.

23.

24. Add lines 22 and 23. Enter here, then go to line 27.

24.

25. Overpayment. If line 21 is more than line 14, subtract

line 14 from line 21. Then go to line 18 of next column

25.

26. Number of days until next estimated payment date

26.

61

92

122

90

27. Interest: Days from line 26 X .12 X Amount on line 24

365

27.

28. Underpayment Interest Penalty. Add the amounts on line 27 of each column.

Enter total here and on line 64 of Form 2, line 37 of Form 2S, or line 51 of Form FID-3

28. $

117

Attach this form to your return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2