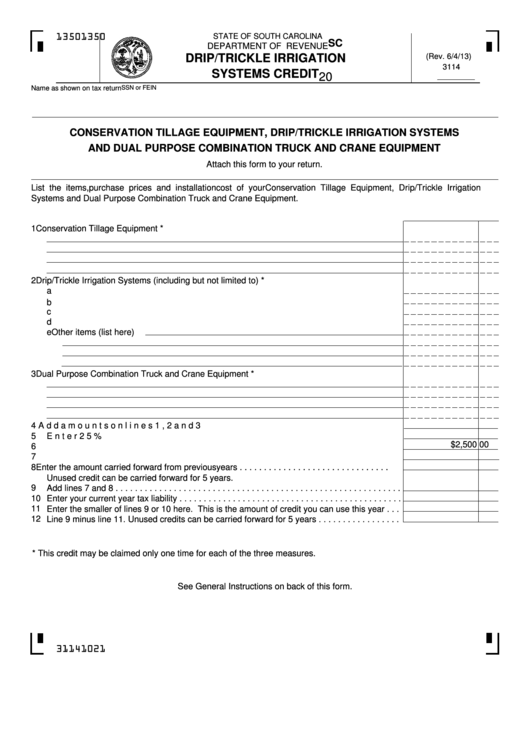

Form Sc Sch.tc-1 - Drip/trickle Irrigation Systems Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-1

DEPARTMENT OF REVENUE

(Rev. 6/4/13)

DRIP/TRICKLE IRRIGATION

3114

SYSTEMS CREDIT

20

Name as shown on tax return

SSN or FEIN

CONSERVATION TILLAGE EQUIPMENT, DRIP/TRICKLE IRRIGATION SYSTEMS

AND DUAL PURPOSE COMBINATION TRUCK AND CRANE EQUIPMENT

Attach this form to your return.

List the items, purchase prices and installation cost of your Conservation Tillage Equipment, Drip/Trickle Irrigation

Systems and Dual Purpose Combination Truck and Crane Equipment.

1

Conservation Tillage Equipment *

2

Drip/Trickle Irrigation Systems (including but not limited to) *

a

Dams . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

Pipe . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

Pumps . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d

Wells. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e

Other items (list here)

3

Dual Purpose Combination Truck and Crane Equipment *

4

Add amounts on lines 1, 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Enter 25% of line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$2,500 00

6

Maximum credit allowed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Lesser of lines 5 or 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Enter the amount carried forward from previous years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unused credit can be carried forward for 5 years.

9

Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Enter your current year tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

Enter the smaller of lines 9 or 10 here. This is the amount of credit you can use this year . . .

12

Line 9 minus line 11. Unused credits can be carried forward for 5 years . . . . . . . . . . . . . . . . .

* This credit may be claimed only one time for each of the three measures.

See General Instructions on back of this form.

31141021

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2