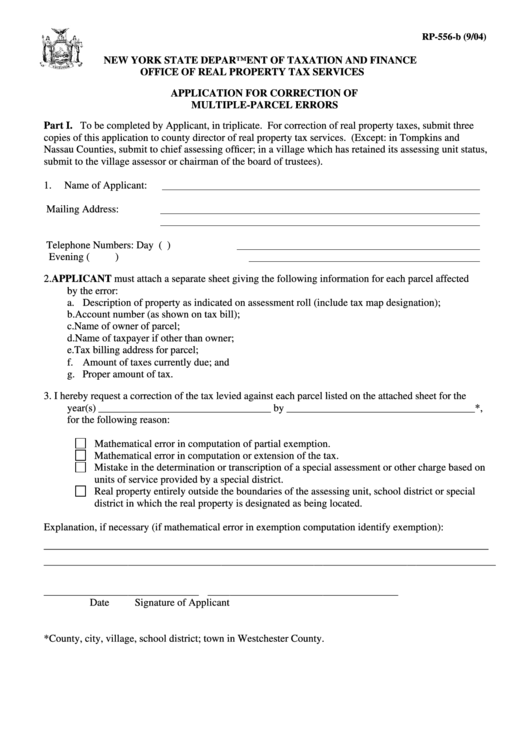

RP-556-b (9/04)

NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR CORRECTION OF

MULTIPLE-PARCEL ERRORS

Part I. To be completed by Applicant, in triplicate. For correction of real property taxes, submit three

copies of this application to county director of real property tax services. (Except: in Tompkins and

Nassau Counties, submit to chief assessing officer; in a village which has retained its assessing unit status,

submit to the village assessor or chairman of the board of trustees).

1.

Name of Applicant:

Mailing Address:

Telephone Numbers:

Day (

)

Evening (

)

2.

APPLICANT must attach a separate sheet giving the following information for each parcel affected

by the error:

a. Description of property as indicated on assessment roll (include tax map designation);

b. Account number (as shown on tax bill);

c. Name of owner of parcel;

d. Name of taxpayer if other than owner;

e. Tax billing address for parcel;

f. Amount of taxes currently due; and

g. Proper amount of tax.

3.

I hereby request a correction of the tax levied against each parcel listed on the attached sheet for the

year(s)

_________________________________ by ____________________________________*,

for the following reason:

Mathematical error in computation of partial exemption.

Mathematical error in computation or extension of the tax.

Mistake in the determination or transcription of a special assessment or other charge based on

units of service provided by a special district.

Real property entirely outside the boundaries of the assessing unit, school district or special

district in which the real property is designated as being located.

Explanation, if necessary (if mathematical error in exemption computation identify exemption):

_____________________________________________________________________________________

______________________________________________________________________________________________________

___________________________________

___________________________________________

Date

Signature of Applicant

*County, city, village, school district; town in Westchester County.

1

1 2

2