Form St-101.10 - Annual Schedule Fr - Sales And Use Tax On Qualified Motor Fuel And Highway Diesel Motor Fuel - 2015 Page 4

ADVERTISEMENT

A15

Sales tax identification number

Page 4 of 4 ST-101.10 (2/15)

Annual Schedule FR

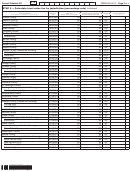

STEP 5 — Calculate local sales tax by jurisdiction (percentage rate)

(continued)

Column A

Column B

Column C

Column D

Column E

Column F

+

×

=

Taxing jurisdiction

Jurisdiction

Motor fuel

Highway diesel motor fuel

Tax rate

Sales and use tax

taxable sales and self-use

(C + D) x E

code

taxable sales and self-use

(Jurisdictions are listed in county order)

Wyoming County

WY R5614

.00

.00

4%

Yates County

YA R5714

.00

.00

4%

New York City

NE R8024

.00

.00

4½%

5

Column total (Step 5):

6

Amount from Step 3, box 1:

7

Amount from Step 3A, box 2:

8

Amount from Step 4, box 3:

9

Amount from Step 4A, box 4:

10

Total:

(Box 5 + box 6 + box 7 + box 8 + box 9)

STEP 6 — Calculate tax adjustments

Motor fuel

Diesel motor fuel

CR T4444

CR X8888

Enter the box 17

11

14

amount on Form ST-101,

Credit for prepaid sales tax

[

]

[

]

page 4, Step 7A on the

Schedule FR line. Be sure

12

15

to enter this amount as a

Refunds received or requested

positive number.

13

16

17

Net credit

Box 11 minus box 12 = box 13

[

]

[

]

+

[

]

=

Box 14 minus box 15 = box 16

18

Adjusted tax:

(Box 10 minus box 17)

Enter the box 18

amount on Form ST-101,

page 2, Column F, in box 2.

STEP 7 — Sales and use of nonqualified fuel

Nonqualified gallons sold or used

If you are claiming credit in Step 6 for prepaid sales tax you paid on fuel you sold or used as

nonqualified fuel, enter the number of gallons you sold or used as nonqualified fuel. Nonqualified fuel

Motor fuel

Diesel motor fuel

is motor fuel and highway diesel motor fuel that is not sold as qualified fuel. Do not include sales of

nonhighway diesel motor fuel (i.e., clear kerosene delivered and sold for heating) in this amount. If you

gal.

gal.

are claiming credit for prepaid sales tax paid on fuel you sold as nonhighway fuel, and did not sell any

.

nonqualified fuel, enter 0

ST-101

FR

Insert Form ST‑101.10

inside Form ST‑101

11000402150094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4