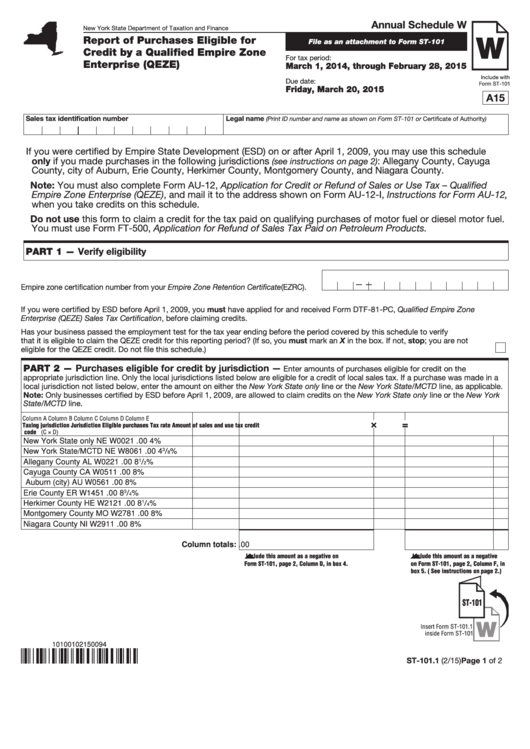

Form St-101.1 - Annual Schedule W - Report Of Purchases Eligible For Credit By A Qualified Empire Zone Enterprise (Qeze) - 2015

ADVERTISEMENT

Annual Schedule W

New York State Department of Taxation and Finance

W

Report of Purchases Eligible for

File as an attachment to Form ST-101

Credit by a Qualified Empire Zone

For tax period:

Enterprise (QEZE)

March 1, 2014, through February 28, 2015

Include with

Due date:

Form ST-101

Friday, March 20, 2015

A15

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-101 or Certificate of Authority)

If you were certified by Empire State Development (ESD) on or after April 1, 2009, you may use this schedule

only if you made purchases in the following jurisdictions

: Allegany County, Cayuga

(see instructions on page 2)

County, city of Auburn, Erie County, Herkimer County, Montgomery County, and Niagara County.

Note: You must also complete Form AU-12, Application for Credit or Refund of Sales or Use Tax – Qualified

Empire Zone Enterprise (QEZE), and mail it to the address shown on Form AU-12-I, Instructions for Form AU-12,

when you take credits on this schedule.

Do not use this form to claim a credit for the tax paid on qualifying purchases of motor fuel or diesel motor fuel.

You must use Form FT-500, Application for Refund of Sales Tax Paid on Petroleum Products.

PART 1 — Verify eligibility

—

—

Empire zone certification number from your Empire Zone Retention Certificate (EZRC). ....

If you were certified by ESD before April 1, 2009, you must have applied for and received Form DTF-81-PC, Qualified Empire Zone

Enterprise (QEZE) Sales Tax Certification, before claiming credits.

Has your business passed the employment test for the tax year ending before the period covered by this schedule to verify

that it is eligible to claim the QEZE credit for this reporting period? (If so, you must mark an X in the box. If not, stop; you are not

eligible for the QEZE credit. Do not file this schedule.) ..................................................................................................................................

PART 2 — Purchases eligible for credit by jurisdiction —

Enter amounts of purchases eligible for credit on the

appropriate jurisdiction line. Only the local jurisdictions listed below are eligible for a credit of local sales tax. If a purchase was made in a

local jurisdiction not listed below, enter the amount on either the New York State only line or the New York State/MCTD line, as applicable.

Note: Only businesses certified by ESD before April 1, 2009, are allowed to claim credits on the New York State only line or the New York

State/MCTD line.

Column A

Column B

Column C

Column D

Column E

×

=

Taxing jurisdiction

Jurisdiction

Eligible purchases

Tax rate

Amount of sales and use tax credit

code

(C × D)

New York State only

NE W0021

.00

4%

/

3

New York State/MCTD

NE W8061

.00

4

%

8

/

1

Allegany County

AL W0221

.00

8

%

2

Cayuga County

CA W0511

.00

8%

Auburn (city)

AU W0561

.00

8%

/

3

Erie County

ER W1451

.00

8

%

4

/

1

Herkimer County

HE W2121

.00

8

%

4

Montgomery County

MO W2781

.00

8%

Niagara County

NI W2911

.00

8%

Column totals:

.00

Include this amount as a negative on

Include this amount as a negative

Form ST-101, page 2, Column D, in box 4.

on Form ST-101, page 2, Column F, in

box 5. ( See instructions on page 2.)

ST-101

W

Insert Form ST-101.1

inside Form ST-101

10100102150094

ST-101.1 (2/15) Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2