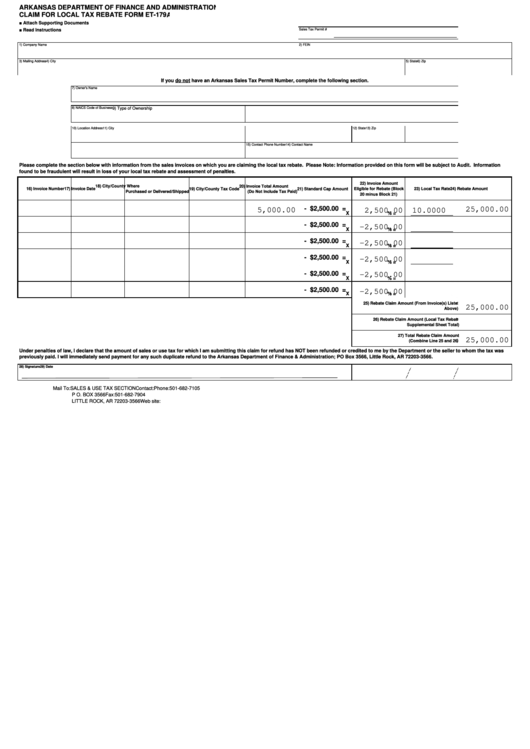

ARKANSAS DEPARTMENT OF FINANCE AND ADMINISTRATION

CLAIM FOR LOCAL TAX REBATE FORM ET-179A

■ Attach Supporting Documents

■ Read Instructions

Sales Tax Permit #

1) Company Name

2) FEIN

3) Mailing Address

4) City

5) State

6) Zip

If you do not have an Arkansas Sales Tax Permit Number, complete the following section.

7) Owner's Name

8) NAICS Code of Business

9) Type of Ownership

10) Location Address

11) City

12) State

13) Zip

14) Contact Name

15) Contact Phone Number

Please complete the section below with information from the sales invoices on which you are claiming the local tax rebate. Please Note: Information provided on this form will be subject to Audit. Information

found to be fraudulent will result in loss of your local tax rebate and assessment of penalties.

22) Invoice Amount

18) City/County Where

20) Invoice Total Amount

16) Invoice Number

17) Invoice Date

19) City/County Tax Code

21) Standard Cap Amount

Eligible for Rebate (Block

23) Local Tax Rate

24) Rebate Amount

Purchased or Delivered/Shipped

(Do Not Include Tax Paid)

20 minus Block 21)

- $2,500.00 =

25,000.00

5,000.00

10.0000

2,500.00

X

% =

- $2,500.00 =

-2,500.00

X

% =

- $2,500.00 =

-2,500.00

X

% =

- $2,500.00 =

-2,500.00

X

% =

- $2,500.00 =

-2,500.00

X

% =

- $2,500.00 =

-2,500.00

X

% =

25) Rebate Claim Amount (From Invoice(s) Listed

25,000.00

Above)

26) Rebate Claim Amount (Local Tax Rebate

Supplemental Sheet Total)

27) Total Rebate Claim Amount

25,000.00

(Combine Line 25 and 26)

Under penalties of law, I declare that the amount of sales or use tax for which I am submitting this claim for refund has NOT been refunded or credited to me by the Department or the seller to whom the tax was

previously paid. I will immediately send payment for any such duplicate refund to the Arkansas Department of Finance & Administration; PO Box 3566, Little Rock, AR 72203-3566.

28) Signature

29) Date

Mail To: SALES & USE TAX SECTION

Contact:

Phone: 501-682-7105

P O. BOX 3566

Fax: 501-682-7904

LITTLE ROCK, AR 72203-3566

Web site:

1

1 2

2 3

3