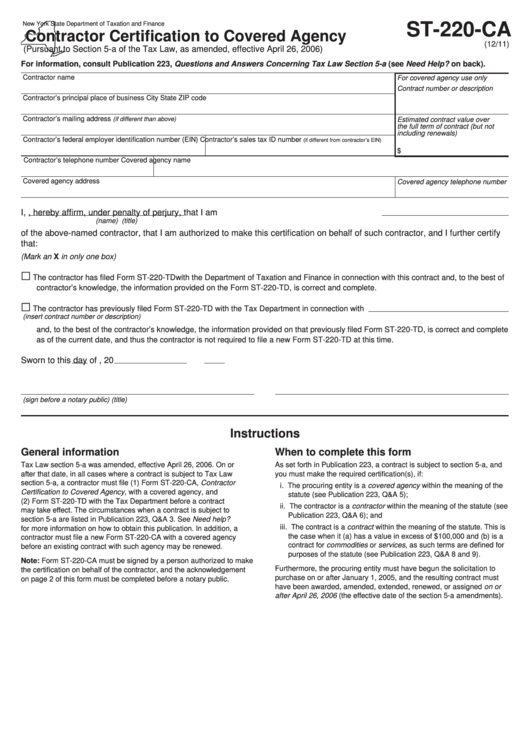

ST-220-CA

New York State Department of Taxation and Finance

Contractor Certification to Covered Agency

(12/11)

(Pursuant to Section 5-a of the Tax Law, as amended, effective April 26, 2006)

For information, consult Publication 223, Questions and Answers Concerning Tax Law Section 5-a (see Need Help? on back).

Contractor name

For covered agency use only

Contract number or description

Contractor’s principal place of business

City

State

ZIP code

Contractor’s mailing address

(if different than above)

Estimated contract value over

the full term of contract (but not

including renewals)

Contractor’s federal employer identification number (EIN)

Contractor’s sales tax ID number

(if different from contractor’s EIN)

$

Contractor’s telephone number

Covered agency name

Covered agency address

Covered agency telephone number

I,

, hereby affirm, under penalty of perjury, that I am

(name)

(title)

of the above-named contractor, that I am authorized to make this certification on behalf of such contractor, and I further certify

that:

(Mark an X in only one box)

G

The contractor has filed Form ST-220-TD with the Department of Taxation and Finance in connection with this contract and, to the best of

contractor’s knowledge, the information provided on the Form ST-220-TD, is correct and complete.

G

The contractor has previously filed Form ST-220-TD with the Tax Department in connection with

(insert contract number or description)

and, to the best of the contractor’s knowledge, the information provided on that previously filed Form ST-220-TD, is correct and complete

as of the current date, and thus the contractor is not required to file a new Form ST-220-TD at this time.

Sworn to this

day of

, 20

(sign before a notary public)

(title)

Instructions

General information

When to complete this form

Tax Law section 5-a was amended, effective April 26, 2006. On or

As set forth in Publication 223, a contract is subject to section 5-a, and

after that date, in all cases where a contract is subject to Tax Law

you must make the required certification(s), if:

section 5-a, a contractor must file (1) Form ST-220-CA, Contractor

i. The procuring entity is a covered agency within the meaning of the

Certification to Covered Agency, with a covered agency, and

statute (see Publication 223, Q&A 5);

(2) Form ST-220-TD with the Tax Department before a contract

ii. The contractor is a contractor within the meaning of the statute (see

may take effect. The circumstances when a contract is subject to

Publication 223, Q&A 6); and

section 5-a are listed in Publication 223, Q&A 3. See Need help?

iii. The contract is a contract within the meaning of the statute. This is

for more information on how to obtain this publication. In addition, a

the case when it (a) has a value in excess of $100,000 and (b) is a

contractor must file a new Form ST-220-CA with a covered agency

contract for commodities or services, as such terms are defined for

before an existing contract with such agency may be renewed.

purposes of the statute (see Publication 223, Q&A 8 and 9).

Note: Form ST-220-CA must be signed by a person authorized to make

Furthermore, the procuring entity must have begun the solicitation to

the certification on behalf of the contractor, and the acknowledgement

purchase on or after January 1, 2005, and the resulting contract must

on page 2 of this form must be completed before a notary public.

have been awarded, amended, extended, renewed, or assigned on or

after April 26, 2006 (the effective date of the section 5-a amendments).

1

1 2

2