Form St-28w - Retailer/contractor Exemption Certificate - 2005

ADVERTISEMENT

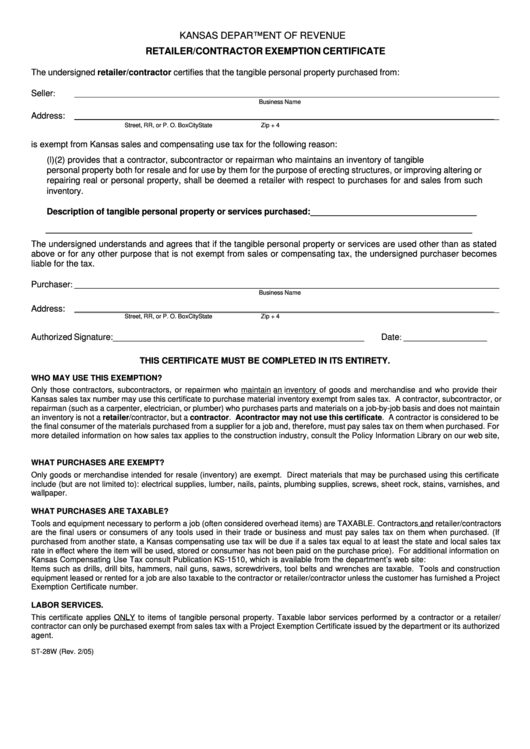

KANSAS DEPARTMENT OF REVENUE

RETAILER/CONTRACTOR EXEMPTION CERTIFICATE

The undersigned retailer/contractor certifies that the tangible personal property purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

is exempt from Kansas sales and compensating use tax for the following reason:

K.S.A. 79-3603(l)(2) provides that a contractor, subcontractor or repairman who maintains an inventory of tangible

personal property both for resale and for use by them for the purpose of erecting structures, or improving altering or

repairing real or personal property, shall be deemed a retailer with respect to purchases for and sales from such

inventory.

Description of tangible personal property or services purchased: ___________________________________

__________________________________________________________________________________________

The undersigned understands and agrees that if the tangible personal property or services are used other than as stated

above or for any other purpose that is not exempt from sales or compensating tax, the undersigned purchaser becomes

liable for the tax.

Purchaser

: _________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

Authorized Signature: _____________________________________________________

Date

: ___________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS EXEMPTION?

Only those contractors, subcontractors, or repairmen who maintain an inventory of goods and merchandise and who provide their

Kansas sales tax number may use this certificate to purchase material inventory exempt from sales tax. A contractor, subcontractor, or

repairman (such as a carpenter, electrician, or plumber) who purchases parts and materials on a job-by-job basis and does not maintain

an inventory is not a retailer/contractor, but a contractor. A contractor may not use this certificate. A contractor is considered to be

the final consumer of the materials purchased from a supplier for a job and, therefore, must pay sales tax on them when purchased. For

more detailed information on how sales tax applies to the construction industry, consult the Policy Information Library on our web site,

WHAT PURCHASES ARE EXEMPT?

Only goods or merchandise intended for resale (inventory) are exempt. Direct materials that may be purchased using this certificate

include (but are not limited to): electrical supplies, lumber, nails, paints, plumbing supplies, screws, sheet rock, stains, varnishes, and

wallpaper.

WHAT PURCHASES ARE TAXABLE?

Tools and equipment necessary to perform a job (often considered overhead items) are TAXABLE. Contractors and retailer/contractors

are the final users or consumers of any tools used in their trade or business and must pay sales tax on them when purchased. (If

purchased from another state, a Kansas compensating use tax will be due if a sales tax equal to at least the state and local sales tax

rate in effect where the item will be used, stored or consumer has not been paid on the purchase price). For additional information on

Kansas Compensating Use Tax consult Publication KS-1510, which is available from the department’s web site:

Items such as drills, drill bits, hammers, nail guns, saws, screwdrivers, tool belts and wrenches are taxable. Tools and construction

equipment leased or rented for a job are also taxable to the contractor or retailer/contractor unless the customer has furnished a Project

Exemption Certificate number.

LABOR SERVICES.

This certificate applies ONLY to items of tangible personal property. Taxable labor services performed by a contractor or a retailer/

contractor can only be purchased exempt from sales tax with a Project Exemption Certificate issued by the department or its authorized

agent.

ST-28W (Rev. 2/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1