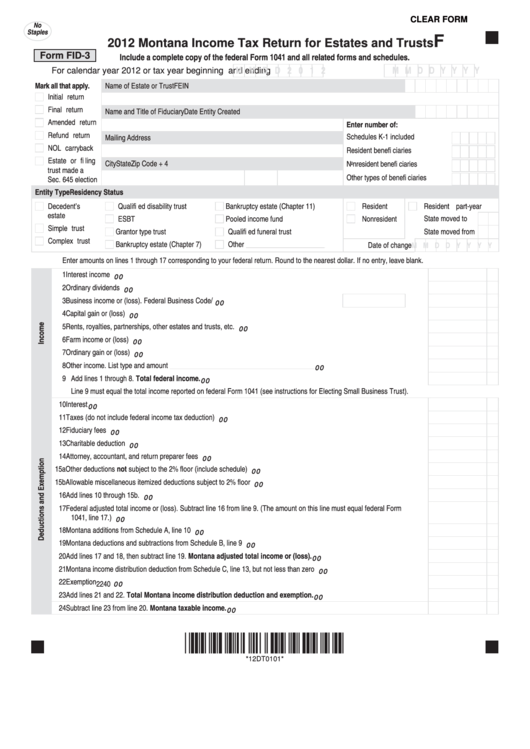

CLEAR FORM

No

Staples

F

2012 Montana Income Tax Return for Estates and Trusts

Form FID-3

Include a complete copy of the federal Form 1041 and all related forms and schedules.

M M D D 2 0 1 2

M M D D Y Y Y Y

For calendar year 2012 or tax year beginning

and ending

Mark all that apply.

Name of Estate or Trust

FEIN

Initial return

Final return

Name and Title of Fiduciary

Date Entity Created

M M D D Y Y Y Y

Amended return

Enter number of:

Refund return

Schedules K-1 included

Mailing Address

NOL carryback

Resident benefi ciaries

Estate or fi ling

City

State

Zip Code + 4

Nonresident benefi ciaries

trust made a

Other types of benefi ciaries

Sec. 645 election

Entity Type

Residency Status

Decedent’s

Qualifi ed disability trust

Bankruptcy estate (Chapter 11)

Resident

Resident part-year

estate

ESBT

Pooled income fund

Nonresident

State moved to

Simple trust

Grantor type trust

Qualifi ed funeral trust

State moved from

Complex trust

Bankruptcy estate (Chapter 7)

Other ______________________

______________________

Date of change

M M D D Y Y Y Y

Enter amounts on lines 1 through 17 corresponding to your federal return. Round to the nearest dollar. If no entry, leave blank.

1 Interest income ........................................................................................................................................................................... 1

00

2 Ordinary dividends ...................................................................................................................................................................... 2

00

3 Business income or (loss).

Federal Business Code/NAICS

...... 3

00

4 Capital gain or (loss) ................................................................................................................................................................... 4

00

5 Rents, royalties, partnerships, other estates and trusts, etc. ...................................................................................................... 5

00

6 Farm income or (loss) ................................................................................................................................................................. 6

00

7 Ordinary gain or (loss) ................................................................................................................................................................ 7

00

8 Other income. List type and amount

_________________________________________

....................................................... 8

00

9 Add lines 1 through 8. Total federal income. ............................................................................................................................ 9

00

Line 9 must equal the total income reported on federal Form 1041 (see instructions for Electing Small Business Trust).

10 Interest ......................................................................................................................................................................................10

00

11 Taxes (do not include federal income tax deduction) ............................................................................................................... 11

00

12 Fiduciary fees ........................................................................................................................................................................... 12

00

13 Charitable deduction ................................................................................................................................................................. 13

00

14 Attorney, accountant, and return preparer fees ........................................................................................................................ 14

00

15a Other deductions not subject to the 2% fl oor (include schedule) ........................................................................................... 15a

00

15b Allowable miscellaneous itemized deductions subject to 2% fl oor ......................................................................................... 15b

00

16 Add lines 10 through 15b. ......................................................................................................................................................... 16

00

17 Federal adjusted total income or (loss). Subtract line 16 from line 9. (The amount on this line must equal federal Form

1041, line 17.) ........................................................................................................................................................................... 17

00

18 Montana additions from Schedule A, line 10 ............................................................................................................................ 18

00

19 Montana deductions and subtractions from Schedule B, line 9 ................................................................................................ 19

00

20 Add lines 17 and 18, then subtract line 19. Montana adjusted total income or (loss). ........................................................ 20

00

21 Montana income distribution deduction from Schedule C, line 13, but not less than zero ....................................................... 21

00

22 Exemption ................................................................................................................................................................................. 22

2240 00

23 Add lines 21 and 22. Total Montana income distribution deduction and exemption. ........................................................ 23

00

24 Subtract line 23 from line 20. Montana taxable income. ........................................................................................................ 24

00

*12DT0101*

*12DT0101*

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8