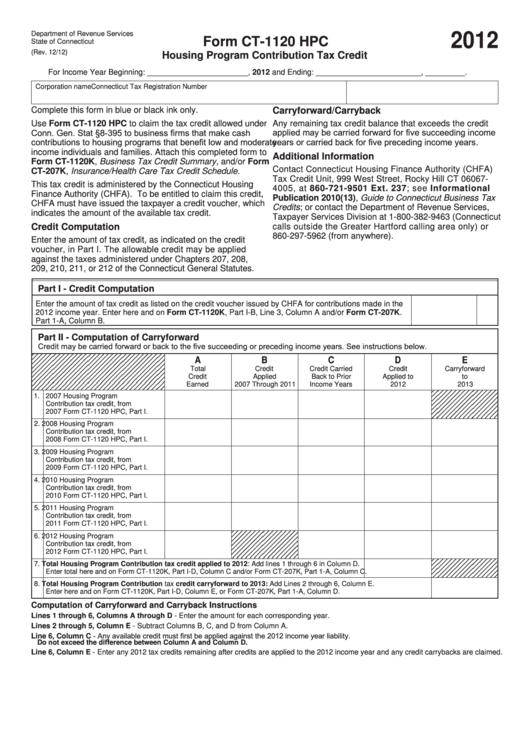

Form Ct-1120 Hpc - Housing Program Contribution Tax Credit - 2012

ADVERTISEMENT

Department of Revenue Services

2012

Form CT-1120 HPC

State of Connecticut

(Rev. 12/12)

Housing Program Contribution Tax Credit

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

Carryforward/Carryback

Use Form CT-1120 HPC to claim the tax credit allowed under

Any remaining tax credit balance that exceeds the credit

Conn. Gen. Stat §8-395 to business firms that make cash

applied may be carried forward for five succeeding income

contributions to housing programs that benefit low and moderate

years or carried back for five preceding income years.

income individuals and families. Attach this completed form to

Additional Information

Form CT-1120K, Business Tax Credit Summary, and/or Form

Contact Connecticut Housing Finance Authority (CHFA)

CT-207K, Insurance/Health Care Tax Credit Schedule.

Tax Credit Unit, 999 West Street, Rocky Hill CT 06067-

This tax credit is administered by the Connecticut Housing

4005, at 860-721-9501 Ext. 237; see Informational

Finance Authority (CHFA). To be entitled to claim this credit,

Publication 2010(13), Guide to Connecticut Business Tax

CHFA must have issued the taxpayer a credit voucher, which

Credits; or contact the Department of Revenue Services,

indicates the amount of the available tax credit.

Taxpayer Services Division at 1-800-382-9463 (Connecticut

Credit Computation

calls outside the Greater Hartford calling area only) or

860-297-5962 (from anywhere).

Enter the amount of tax credit, as indicated on the credit

voucher, in Part I. The allowable credit may be applied

against the taxes administered under Chapters 207, 208,

209, 210, 211, or 212 of the Connecticut General Statutes.

Part I - Credit Computation

Enter the amount of tax credit as listed on the credit voucher issued by CHFA for contributions made in the

2012 income year. Enter here and on Form CT-1120K, Part I-B, Line 3, Column A and/or Form CT-207K.

Part 1-A, Column B.

Part II - Computation of Carryforward

Credit may be carried forward or back to the five succeeding or preceding income years. See instructions below.

A

B

C

D

E

Total

Credit

Credit Carried

Credit

Carryforward

Credit

Applied

Back to Prior

Applied to

to

Earned

2007 Through 2011

Income Years

2012

2013

1. 2007 Housing Program

Contribution tax credit, from

2007 Form CT-1120 HPC, Part I.

2. 2008 Housing Program

Contribution tax credit, from

2008 Form CT-1120 HPC, Part I.

3. 2009 Housing Program

Contribution tax credit, from

2009 Form CT-1120 HPC, Part I.

4. 2010 Housing Program

Contribution tax credit, from

2010 Form CT-1120 HPC, Part I.

5. 2011 Housing Program

Contribution tax credit, from

2011 Form CT-1120 HPC, Part I.

6. 2012 Housing Program

Contribution tax credit, from

2012 Form CT-1120 HPC, Part I.

7. Total Housing Program Contribution tax credit applied to 2012: Add lines 1 through 6 in Column D.

Enter total here and on Form CT-1120K, Part I-D, Column C and/or Form CT-207K, Part 1-A, Column C.

8. Total Housing Program Contribution tax credit carryforward to 2013: Add Lines 2 through 6, Column E.

Enter here and on Form CT-1120K, Part I-D, Column E, or Form CT-207K, Part 1-A, Column D.

Computation of Carryforward and Carryback Instructions

Lines 1 through 6, Columns A through D - Enter the amount for each corresponding year.

Lines 2 through 5, Column E - Subtract Columns B, C, and D from Column A.

Line 6, Column C - Any available credit must first be applied against the 2012 income year liability.

Do not exceed the difference between Column A and Column D.

Line 6, Column E - Enter any 2012 tax credits remaining after credits are applied to the 2012 income year and any credit carrybacks are claimed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1