2 of 3

2013

H

Name

Page

SSN

.00

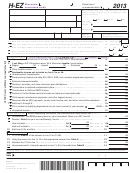

11 a Enter amount from line 10 here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11a

.00

b Workers’ compensation, income continuation, and loss of time insurance (e.g., sick pay) . . . . . . . . 11b

.00

c Gain from sale of home excluded for federal tax purposes (see instructions) . . . . . . . . . . . . . . . . . 11c

.00

d Other capital gains not taxable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11d

.00

e Net operating loss carryforward and capital loss carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11e

f Income of nonresident spouse or part-year resident spouse; nontaxable income from

sources outside Wisconsin; resident manager’s rent reduction; clergy housing allowance;

.00

and nontaxable Native American income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11f

g Partner’s, LLC member’s, and S corporation shareholder’s distributive share of depreciation,

Section 179 expense, depletion, amortization, and intangible drilling costs. If none was claimed,

write “None” on federal Schedule E, Part II, near the entity’s name . . . . . . . . . . . . . . . . . . . . . . . . . 11g

.00

.00

h Car or truck depreciation (standard mileage rate) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11h

i Other depreciation, Section 179 expense, depletion, amortization, and intangible drilling costs . . . 11i

.00

.00

12 a Subtotal. Add lines 11a through 11i . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12a

.00

b Number of qualifying dependents.

x $500 =

12b

Do not count yourself or your spouse (see page 11)

.00

c Household income. Subtract line 12b from line 12a

. . . . . . . . . . 12c

(if $24,680 or more, no credit is allowed)

Taxes and/or Rent

See pages 11 to 14.

see Schedule 1, page 3

A Check here if your home was located on more than one acre of land and was not part of a farm;

. . . . . . . . . . A

B Check here if your home was located on more than one acre of land and was part of a farm . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B

C Check here if your home was used for other than personal or farm purposes while you lived there in 2013;

see Schedule 2, page 3

. . . C

D Check here if you received Wisconsin Works (W2) payments or county relief during 2013;

see Schedule 3, page 3

. . . . . . . . . . . . . . . . D

.00

13

Homeowners – Net 2013 property taxes on your homestead, whether paid or not . . . . . . . . . . . . . 13

See pages 12 to 14.

14

Renters–

.

Rent from your rent certificate(s), line 5a

(or Shared Living Expenses Schedule)

(5b of rent certificate is “Yes”)

.00

.00

Heat included

. . . . . . . . . . . . . 14a

x .20 (20%) = 14b

(5b of rent certificate is “No”)

.00

.00

Heat not included

. . . . . . . . . . . 14c

x .25 (25%) = 14d

.00

15

Total of lines 13, 14b, and 14d

. . . . . . . . . . . . . . . . . . . . . . . . . . 15

(or amount from line 6 of Schedule 3)

ATTACH 2013 tax bill(s) (or closing statement) and/or original rent certificate(s).

Don’t delay your refund:

See page 12.

ATTACH ownership document (if the tax bill lists names other than yours).

Credit Computation

.00

16

Fill in the smaller of (a) amount on line 15 or (b) $1,460 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Using the amount on line 12c, fill in the appropriate amount from Table A (page 17) . . . . . . . . . . . 17

.00

Subtract line 17 from line 16 (if line 17 is more than line 16, fill in 0; no credit is allowable) . . . . 18

.00

18

19 Homestead credit – Using the amount on line 18, fill in the credit from Table B (page 18) . . . . . . . 19

.00

If you file a Wisconsin income tax return, attach this claim behind Form 1, 1A, or 1NPR. Fill in

your homestead credit (line 19) on line 32 of Form 1A; line 46 of Form 1; or line 71 of Form 1NPR.

(If filing Form 1 or Form 1NPR, ATTACH a complete copy of your federal income tax return and

schedules.) You cannot file Form WI-Z with a homestead credit claim.

Under penalties of law, I declare this homestead credit claim and all attachments are true, correct, and complete to the best of my knowledge and belief.

Claimant’s signature

Spouse’s signature

Date

Daytime phone number

Sign

(

)

Here

For Department Use Only

Mail to:

C

DON’T file this claim UNLESS a

Wisconsin Department of Revenue

rent certificate or property tax bill

STOP

PO Box 34

(or closing statement) is included.

Madison WI 53786-0001

1

1 2

2 3

3