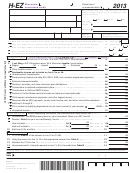

3 of 3

2013

H

Name

Page

SSN

Note: Include this page as part of Schedule H only if Schedule 1, 2, and/or 3 is completed.

Schedule 1

Allowable Taxes – Home on More Than One Acre of Land

• Homeowners: Complete this schedule if your home

.00

1 Assessed value of land (from tax bill) . . . . 1

was on more than one acre of land and was not part of

2 Number of acres of land . . . . . . . . . . . . . 2

a farm (as defined on page 5 of the instructions). Claim

.00

3 Divide line 1 by line 2 . . . . . . . . . . . . . . . . 3

only the property taxes on one acre of land and the

buildings on it.

4 Assessed value of improvements

.00

• Renters: If your home was on more than one acre of land

. . . . . . . . . . . . . . . . . . . . . . . 4

(from tax bill)

and was not part of a farm, do not complete Schedule 1,

.00

5 Add line 3 and line 4 . . . . . . . . . . . . . . . . 5

but see exception 4 under “Exceptions: Homeowners

.00

6 Add line 1 and line 4 (total assessed value) . . 6

and/or Renters” (page 14) for instructions.

7 Divide line 5 by line 6 (carry the decimal

• Do not complete this schedule if your home was part

.

. . . . . . . . . . . . . . . . . . . . . . 7

to four places)

of a farm. You may claim the property taxes on up to

8 Net 2013 property taxes (see instructions

120 acres of land adjoining your home and all improve-

.00

for line 13 of Schedule H, on pages 11 to 14)

. . 8

ments on those 120 acres.

• If you wish to use a different method to prorate your

9 Multiply line 8 by line 7. Fill in here and

on line 13 of Schedule H or line 1 of

property taxes, attach to Schedule H your computation

.00

Schedule 2 or 3 below . . . . . . . . . . . . . . . 9

of allowable property taxes.

Schedule 2

Allowable Taxes/Rent – Home Used Partly for Purposes Other Than Farm or Personal Use

• Complete this schedule if your homestead (as defined

1 Net 2013 property taxes/rent or

on page 5 of the instructions) was not part of a farm but

amount from line 9 of Schedule 1

.00

was used partly for purposes other than personal use

(see pages 11 to 14) . . . . . . . . . . . . . . . . . 1

while you lived there in 2013. Only the personal portion

2 Percentage of homestead used

of your property taxes/rent may be claimed.

%

solely for personal purposes . . . . . . . . . . 2

• “Other uses” include part business or rental use where

3 Multiply line 1 by line 2. Fill in here and

a deduction is allowed or allowable for tax purposes,

on line 13, 14a, or 14c of Schedule H,

and a separate unit occupied by others rent free.

.00

or on line 1 or 2 of Schedule 3 below . . . 3

See paragraph 3 under “Exceptions: Homeowners

and/or Renters” (page 13) for examples and additional

information.

Schedule 3

Taxes/Rent Reduction – Wisconsin Works (W2) or County Relief Recipients

1 Homeowners – fill in the net 2013

Complete this schedule if, for any month of 2013, you

received a) Wisconsin Works (W2) payments of any amount,

property taxes on your homestead or the

.00

or b) county relief payments of $400 or more. If you received

amount from line 3 of Schedule 2 . . . . . . 1

these payments for all 12 months of 2013, do not complete

2 Renters – if heat was included, fill in

Schedule H; you do not qualify for homestead credit.

20% (.20), or if heat was not included,

fill in 25% (.25), of rent from line 5a of the

Example: You received Wisconsin Works payments for

rent certificate(s) or line 3 of Schedule 2 . . 2

.00

4 months in 2013. Rent paid for 2013 was $4,500, and

3 Add line 1 and line 2; fill in the smaller of

heat was included.

.00

a) the total of lines 1 and 2, or b) $1,460 . . 3

Line

.00

4 Divide line 3 by 12 . . . . . . . . . . . . . . . . . . . 4

2

20% of rent paid ($4,500 x .20) . . . . . . . . . . . $900

5 Number of months in 2013 for which you

4

Monthly rent ($900 ÷ 12) . . . . . . . . . . . . . . . . $475

did not receive a) any Wisconsin Works

5

Number of months no Wisconsin Works

(W2) payments, or b) county relief

received . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

payments of $400 or more . . . . . . . . . . . . 5

6

Reduced rent ($75 x 8 months) . . . . . . . . . . . $600

6 Multiply line 4 by line 5. Fill in here and on

line 15 of Schedule H. Do not fill in line 13

In this example, $600 would be filled in on line 15 of

.00

line 13 or 14 . . . . . . . . . . . . . . . . . . . . . . . 6

Schedule H.

Homeowners Age 65 or Older – The Property Tax Deferral Loan Program provides loans to help individuals age 65

Note

or older pay their property taxes. Qualified applicants may participate even if they receive homestead credit. For

more information, contact the Wisconsin Housing and Economic Development Authority at (608) 266-7884 (Madison),

(414) 227-4039 (Milwaukee), or 1-800-755-7835.

I-016bi

1

1 2

2 3

3