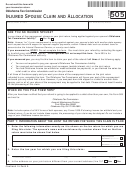

Page 2

Part II

Allocation Between Spouses of Items on the Joint Tax Return

(a) Amount shown

(b) Allocated to

(c) Allocated to

Allocated Items

on joint return

injured spouse

other spouse

SSN:

SSN:

7 Income. Enter the separate income

that each spouse earned. Allocate joint

income, such as interest earned on a

joint bank account, as you determine.

But be sure to allocate all income

shown on the joint return.

a Wages . . . . . . . . . . . . . . . . . . . . . .

b All other income. Identify the type and

amount.

8 Allowable deductions. Enter each

spouse’s separate deductions, such as

employee business expenses. Allocate

other deductions as you determine . .

9 Credits.

Allocate

any

SP

Tax

Forgiveness credit to the spouse who

was allocated the dependent’s exemp-

tion. Allocate business credits based on

each spouse’s interest in the business.

Allocate any other credits as you deter-

mine. . . . . . . . . . . . . . . . . . . . . . .

10 Pennsylvania income tax withheld.

Enter Pennsylvania income tax with-

held from each spouse’s income as

shown on Forms W-2 and 1099-R. Be

sure to attach copies of these

forms to your tax return, or to

Form PA 8379 if you are filing it by

itself. . . . . . . . . . . . . . . . . . . . . . .

11 Payments. Allocate joint estimated

tax payments as you determine. . . . .

Note: The Department will figure the amount of any refund due the injured spouse.

Part III

Signature

Under penalties of perjury, I declare that I have examined this form and any accompanying schedules or statements, and to the best of my knowledge and belief, they are true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy

Injured spouse’s signature

Phone number (Daytime)

Date

of this form for

your records.

Date

Check if

Preparer’s

Preparer’s SSN or PTIN

Paid

signature

self-employed

Preparer’s

Firm’s name (or yours

EIN

Use Only

if self-employed) and

ZIP code

address

Form PA 8379 (10-10)

1

1 2

2