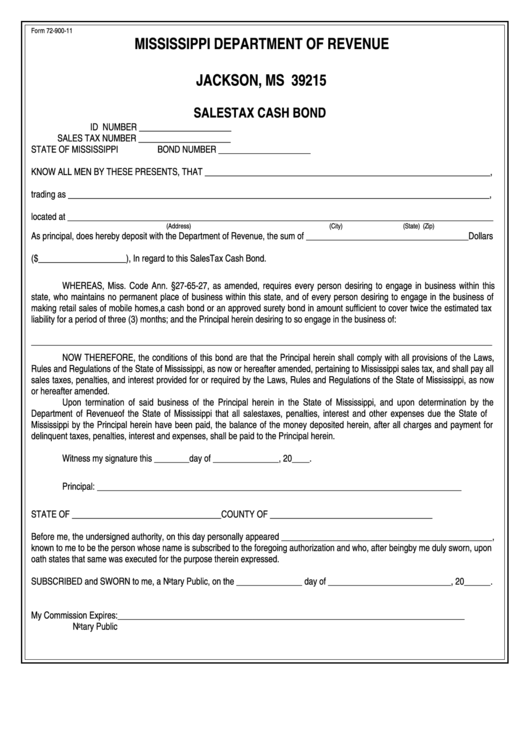

Form 72-900-11

MISSISSIPPI DEPARTMENT OF REVENUE

P.O. BOX 1033

JACKSON, MS 39215

SALES TAX CASH BOND

ID NUMBER _____________________

SALES TAX NUMBER _____________________

STATE OF MISSISSIPPI

BOND NUMBER _____________________

KNOW ALL MEN BY THESE PRESENTS, THAT _________________________________________________________________,

trading as ________________________________________________________________________________________________,

located at _________________________________________________________________________________________________

(Address)

(City)

(State)

(Zip)

As principal, does hereby deposit with the Department of Revenue, the sum of _____________________________________Dollars

($____________________), In regard to this Sales Tax Cash Bond.

WHEREAS, Miss. Code Ann. §27-65-27, as amended, requires every person desiring to engage in business within this

state, who maintains no permanent place of business within this state, and of every person desiring to engage in the business of

making retail sales of mobile homes, a cash bond or an approved surety bond in amount sufficient to cover twice the estimated tax

liability for a period of three (3) months; and the Principal herein desiring to so engage in the business of:

_________________________________________________________________________________________________________

NOW THEREFORE, the conditions of this bond are that the Principal herein shall comply with all provisions of the Laws,

Rules and Regulations of the State of Mississippi, as now or hereafter amended, pertaining to Mississippi sales tax, and shall pay all

sales taxes, penalties, and interest provided for or required by the Laws, Rules and Regulations of the State of Mississippi, as now

or hereafter amended.

Upon termination of said business of the Principal herein in the State of Mississippi, and upon determination by the

Department of Revenue of the State of Mississippi that all sales taxes, penalties, interest and other expenses due the State of

Mississippi by the Principal herein have been paid, the balance of the money deposited herein, after all charges and payment for

delinquent taxes, penalties, interest and expenses, shall be paid to the Principal herein.

Witness my signature this ________ day of _______________, 20____.

Principal: ___________________________________________________________________________________

STATE OF __________________________________

COUNTY OF _____________________________________

Before me, the undersigned authority, on this day personally appeared ________________________________________________,

known to me to be the person whose name is subscribed to the foregoing authorization and who, after being by me duly sworn, upon

oath states that same was executed for the purpose therein expressed.

SUBSCRIBED and SWORN to me, a Notary Public, on the _______________ day of ____________________________, 20______.

My Commission Expires:_______________________________

________________________________________________

Notary Public

1

1