Form 49ER - Page 2

EFO00032p3

12-10-13

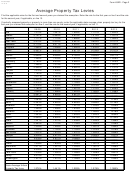

Average Property Tax Levies

FInd the applicable rates for the first and second years you claimed the exemption. Enter the rate for the first year on line 5 and the rate

for the second year, if applicable, on line 10.

If centrally assessed property or property in more than one county, enter the applicable state average urban property tax levy for the

first year you claimed the exemption on line 6, and the rate for the second year, if applicable, on line 11.

2009

2010

2011

2012

2013

Ada

1.313%

1.507%

1.594%

1.721%

1.642%

Adams

0.721%

0.808%

0.915%

1.012%

1.037%

Bannock

1.709%

1.584%

1.771%

1.770%

1.658%

Bear Lake

0.670%

0.644%

0.661%

0.664%

0.751%

Benewah

1.076%

1.182%

0.710%

0.911%

0.954%

Bingham

1.504%

1.498%

1.446%

1.350%

1.393%

Blaine

0.531%

0.610%

0.671%

0.755%

0.797%

Boise

0.679%

0.925%

1.004%

1.091%

1.113%

Bonner

0.649%

0.669%

0.764%

0.809%

0.871%

Bonneville

1.493%

1.488%

1.409%

1.403%

1.410%

Boundary

0.760%

0.803%

0.889%

0.959%

1.020%

Butte

1.408%

1.374%

1.479%

1.257%

1.337%

Camas

0.928%

0.938%

0.962%

1.091%

1.137%

Canyon

1.619%

1.905%

2.026%

2.126%

2.001%

Caribou

1.153%

1.142%

1.045%

1.176%

1.204%

Cassia

1.017%

0.981%

1.012%

1.011%

1.012%

Clark

1.020%

1.034%

0.802%

0.873%

1.008%

Clearwater

0.976%

1.080%

1.196%

1.228%

1.337%

Custer

0.316%

0.408%

0.356%

0.373%

0.457%

Elmore

1.182%

1.439%

1.491%

1.513%

1.609%

Franklin

1.035%

1.086%

1.040%

1.053%

1.098%

Fremont

0.657%

0.840%

0.847%

0.770%

0.877%

Gem

0.944%

1.101%

1.272%

1.435%

1.341%

Gooding

1.135%

1.194%

1.083%

1.115%

1.097%

Idaho

0.593%

0.640%

0.668%

0.688%

0.726%

Jefferson

1.184%

1.154%

1.227%

1.225%

1.309%

Jerome

1.446%

1.498%

1.525%

1.515%

1.540%

Kootenai

0.843%

1.030%

1.161%

1.262%

1.278%

Latah

1.503%

1.526%

1.563%

1.643%

1.694%

Lemhi

0.606%

0.692%

0.676%

0.717%

0.732%

Lewis

1.426%

1.399%

1.241%

1.331%

1.386%

Lincoln

0.950%

1.110%

1.155%

1.205%

1.236%

Madison

1.349%

1.448%

1.449%

1.487%

1.494%

Minidoka

1.082%

1.120%

1.163%

1.075%

1.076%

Nez Perce

1.597%

1.578%

1.591%

1.652%

1.669%

Oneida

0.992%

0.973%

0.958%

0.969%

1.031%

Owyhee

0.839%

0.931%

0.986%

1.103%

1.079%

Payette

1.309%

1.534%

1.282%

1.387%

1.286%

Power

1.559%

1.639%

1.628%

1.501%

1.627%

Shoshone

1.271%

1.341%

1.443%

1.367%

1.458%

Teton

0.595%

0.761%

0.894%

0.956%

1.057%

Twin Falls

1.335%

1.390%

1.488%

1.599%

1.661%

Valley

0.956%

0.966%

0.515%

0.772%

0.865%

Washington

1.038%

1.095%

1.021%

1.072%

1.048%

State Average Urban

Property Tax Levy

1.274%

1.441%

1.293%

1.378%

1.388%

1

1 2

2 3

3