JT-1/UC-001 (7/11)

Page 5

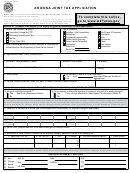

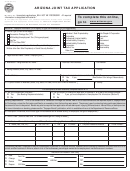

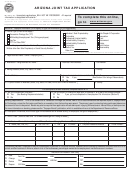

INSTRUCTIONS FOR ARIZONA JOINT TAX APPLICATION

IMPORTANT: You must complete each of the following sections or your application will be returned

•

For licensing questions on Transaction Privilege, Withholding or Use Tax (Department of Revenue) call (602) 542-4576

or 1-800-634-6494 (from area codes 520 and 928).

•

For Unemployment Tax (Department of Economic Security) call (602) 771-6602 or e-mail uit.status@azdes.gov

by the Department of Revenue for each document fi led without a

USE THIS APPLICATION TO:

TIN.

• License New Business: A new business with no previous

4. Enter the Legal Business Name of the Owner or Employing

owners.

Unit (name of corporation as listed in its articles of incorporation,

• Change Ownership: If acquiring or succeeding to all or part of

or individual & spouse, or partners, or organization owning or

an existing business or changing the legal form of your business

controlling the business).

(sole proprietorship to corporation, etc.).

5. Enter the name of the Business/DBA (doing business as)

If you need to update a license, add a business location, get

Name. If same as above, enter “same.”

a copy of your license or make other changes: Complete a

Transaction Privilege Tax License Update form and include

6. Enter the business telephone number including area code.

fees of $12 per location.

7. Enter the fax number including area code.

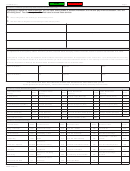

Section A: TAXPAYER INFORMATION

8. and 9. Enter mailing address where all correspondence is to be

1. LICENSE TYPE

sent. You may use your home address, corporate headquarters,

or accounting fi rm’s address, etc. If mailing address differs for

Transaction Privilege Tax (TPT): Anyone involved in an activity

licenses (for instance withholding and unemployment insurance),

taxable under the TPT statutes must apply for a TPT License

please use cover letter to explain.

before engaging in business.

10. Enter the e-mail address (option) for the business or contact

For TPT, you are required to obtain and display a separate license

person.

certifi cate for each business or rental location. This may be

accomplished in one of the following ways:

11. See section G for listing of reservation codes if your business is

located on an Indian Reservation.

Each location may be licensed as a separate business with a

separate license number for purposes of reporting transaction

12. and 13. Enter the physical location of business including

privilege and use taxes individually.

Therefore a separate

county. This can not be a PO Box or Route Number.

application is needed for each location.

14. If you are a construction contractor, read the bonding

Multiple locations may be licensed under a consolidated license

requirements carefully.

number, provided the ownership is the same, to allow fi ling of a

15. If you answered yes, you must complete Section D.

single tax return. If applying for a new license, list the various

16. Describe the major business activity: principal product you

business locations as instructed below.

If already licensed

manufacture, commodity sold, or services performed.

Your

and you are adding locations, do not use this application to

description of the business is very important because it determines

consolidate an existing license. Please submit update form.

your transaction privilege tax rate and provides a basis for state

Withholding & Unemployment Taxes: Employers paying wages

economic forecasting.

or salaries to employees for services performed in the State must

17. Enter the North American Industries Classifi cation System

apply for a Withholding number & Unemployment number.

(NAICS) code identifi ed for your business activity.

Use Tax: Out-of-state vendors (that is, vendors with no Arizona

18.

Identify the owners of the business. Enter as many as

location) making direct sales into Arizona must obtain a Use Tax

applicable; attach a separate sheet if additional space is needed.

Registration Certifi cate. In-state vendors making out-of-state

purchases for their own use (and not for resale) must also obtain

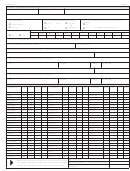

Section B: TRANSACTION PRIVILEGE TAX (TPT)

the Use Tax Registration Certifi cate.

1. Enter the date the business started in Arizona.

TPT for cities only: This type of license is needed if your

2. Enter date sales began in Arizona, or estimate when you plan to

business activity is subject to city TPT that is collected by the

begin selling in Arizona.

state, but the activity is not taxed at the state level. Many of the

larger cities in Arizona administer and collect their own privilege

3. Enter the amount of Transaction Privilege Tax income you can

taxes. Please contact those cities directly to obtain information

reasonably expect to generate in your fi rst twelve months of

regarding licensing requirements.

business. You will be set up for monthly fi ling unless your

anticipated annual income will result in a tax liability of less than

2. TYPE OF OWNERSHIP

$1,250, which may qualify you for quarterly fi ling.

Check as applicable. A corporation must provide the state and

4. For businesses applying for Transaction Privilege and/or Use Tax,

date of incorporation.

enter the applicable business classes based on your activity.

3. Enter your Federal Employer Identifi cation number.

See Section H for listing of business classes.

• Taxpayers are required to provide their taxpayer identifi cation

number (TIN) on all returns and documents. A TIN is defi ned as

the federal employer identifi cation number (EIN), or social security

number (SSN) depending upon how income tax is reported. The

EIN is required for all employers. A penalty of $5 will be assessed

ADOR 10194 (7/11)

1

1 2

2 3

3 4

4 5

5 6

6