JT-1/UC-001 (7/11)

Page 6

5. Cash/Accrual Methods: Cash method requires the payment

13. through 15. Complete as indicated if you know the previous

of tax based on sales receipts actually received during the

owner’s information or, if you merely changed the legal form of

period covered on the tax return. When fi ling under the accrual

your existing business, provide information on your business

method, the tax is calculated on the sales billed rather than actual

under its previous legal form.

receipts.

16. Once certain conditions are met, the law requires employers

6. Complete as indicated.

to provide unemployment insurance coverage to their workers,

but only for services the law defi nes as employment. Check

7. Sellers of new motor vehicles and motor vehicle tires in the state,

Box A if you believe you have not met such conditions and you

for on-road use, are required to report and pay waste tire fees

voluntarily elect to provide such coverage anyway. Check Box

to the Department of Revenue. By checking the box, you will

B if you voluntarily elect to cover your workers who perform

receive form TR-1 on a quarterly basis.

services the law excludes from its defi nition of employment and

8. If your business is seasonal or a transient vendor, indicate the

who are excluded from coverage otherwise. Leave boxes blank

months in which you intend to do business.

if neither choice applies.

9. 10. and 11. Indicate the physical location of your tax records, the

Please note: If you check one or both boxes, then your signature(s)

contact person and their phone number. This can not be a PO

in Section F confi rm(s) your voluntary election to assume liability

Box or Route Number.

for the extent of unemployment coverage your selection indicates

for at least two calendar years, and you will not be permitted to

12. through 25. If you have additional business locations, complete

challenge this election at a later date if it is approved. To learn

this section.

If more space is necessary, attach additional

more, please refer to the Employers’ Handbook or Guide to Arizona

sheets.

Employment Tax Requirements available online at ,

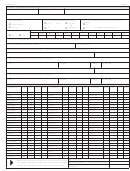

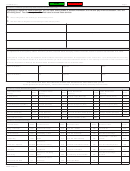

Section C: PROGRAM CITIES / LICENSE FEES

or contact the Unemployment Tax Offi ce Employer Status Unit.

There are no fees for Withholding, Unemployment, or Use Tax

Section E: AZTaxes.gov AUTHORIZED USER INFORMATION

registrations. To calculate the fees for TPT licenses, multiply the

1. through 6. Complete this section if you would like to designate

number of locations in the state by $12. To calculate the city fees,

a security administrator for your online services at

use the listing of program cities in Section C. First, indicate the

gov. The authorized individual will have full access to tax account

number of businesses or physical locations for each of the cities

information and will add or delete users and grant user privileges

for which the Department of Revenue licenses and collects. Then

to view tax account information, fi le tax returns, and remit tax

multiply by the city fee for each city in which you will do business.

payments on behalf of the business identifi ed in Section A. The

Add the columns to determine the total city fees. Fill in the totals

name and e-mail address of the administrator are required for

for state fees and city fees on the application form and total to

registration.

determine the amount due. Make checks payable to the Arizona

Department of Revenue. Be sure to return the city fees sheet with

Section F: SIGNATURES

your application. To obtain licensing for cities not listed on the

The application must be signed only by individuals legally

form, please contact the city directly.

responsible for the business, not agents or representatives.

Section D: WITHHOLDING/UNEMPLOYMENT TAX INFORMATION

Section G: INDIAN RESERVATION CODES

1. through 7. Complete as indicated.

If your business is located on an Indian Reservation, select the

8. Enter the date you acquired the previous owner’s business or

appropriate code from this table and indicate on Section A-11.

changed the legal form of your existing business (sole proprietor

Section H: BUSINESS CLASSES

to corporation, etc).

Select appropriate business classes based on your business

9. Indicate whether you acquired or changed all or only part of the

activities. You must indicate at least one business class on

existing Arizona business. If part, to obtain an unemployment

Section B-4.

tax rate based on the business’s previous account, you must

request it no later than 180 days after the date of acquisition or

legal form of business change; contact the Unemployment Tax

Offi ce Experience Rating Unit for an Application & Agreement

for Severable Portion Experience Rating Transfer (form UC-247;

printable version available online at ).

10. Indicate the manner in which you became the new owner or

operator of this business or, if you merely changed the legal form

of your existing business, check “Other” and explain, for example,

“Changed sole proprietorship to corporation.”.

11. through 12. Complete as indicated if you acquired an existing

business or, if you merely changed the legal form of your existing

business, provide information on your business under its previous

legal form.

ADOR 10194 (7/11)

1

1 2

2 3

3 4

4 5

5 6

6