2

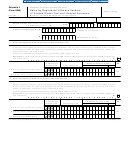

Schedule 2 (Form 8849) (Rev. 1-2009)

Page

Name as shown on Form 8849

EIN

3

Sales by Registered Ultimate Vendors of Kerosene for Use in Aviation

Claimant sold the kerosene for use in aviation at a tax-excluded price and has not collected the amount of tax from the

buyer, repaid the amount of tax to the buyer, or has obtained written consent of the buyer to make the claim. For lines

3a, 3b, 3d, 3e, and 3f, the registered ultimate vendor is eligible to make this claim only if the buyer waives their right to

make the claim by providing the registered ultimate vendor with an unexpired waiver and has no reason to believe any

of the information in the waiver is false. For line 3c, claimant has obtained the required certificate from the buyer and

has no reason to believe any of the information in the certificate is false. See the instructions for additional information

to be submitted.

(c)

Type of

(a)

(b)

(d)

Amount of refund

use

Rate

Gallons

CRN

Multiply col. (a)

by col. (b)

a

Use in commercial aviation (other than foreign trade)

taxed at $.219

$

.175

$

355

b

Use in commercial aviation (other than foreign trade)

taxed at $.244

417

.200

c

Nonexempt use in noncommercial aviation

418

.025

d

346

Other nontaxable uses taxed at $.244

.243

e

369

Other nontaxable uses taxed at $.219

.218

f

LUST tax on aviation fuels used in foreign trade

433

.001

4

Sales by Registered Ultimate Vendors of Gasoline

Claimant sold the gasoline at a tax-excluded price and has not collected the amount of tax from the buyer, repaid the

amount of tax to the buyer, or has obtained written consent of the buyer to make the claim; and obtained an unexpired

certificate from the buyer and has no reason to believe any information in the certificate is false. See the instructions for

additional information to be submitted.

Caution. Claims cannot be made on line 4a or 4b for gasoline purchased by a state or local government or a nonprofit

educational organization for its exclusive use with a credit card issued to the state or local government or nonprofit

educational organization by the credit card issuer.

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

a

Use by a nonprofit educational organization

$ .183

$

362

b

Use by a state or local government

.183

5

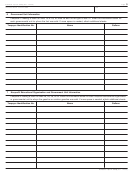

Sales by Registered Ultimate Vendors of Aviation Gasoline

Claimant sold the aviation gasoline at a tax-excluded price and has not collected the amount of tax from the buyer,

repaid the amount of tax to the buyer, or has obtained written consent of the buyer to make the claim; and obtained an

unexpired certificate from the buyer and has no reason to believe any information in the certificate is false. See the

instructions for additional information to be submitted.

Caution. Claims cannot be made on line 5a or 5b for aviation gasoline purchased by a state or local government or a

nonprofit educational organization for its exclusive use with a credit card issued to the state or local government or

nonprofit educational organization by the credit card issuer.

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

a

Use by a nonprofit educational organization

$

.193

$

324

b

Use by a state or local government

.193

Schedule 2 (Form 8849) (Rev. 1-2009)

1

1 2

2 3

3 4

4 5

5