4

Schedule 2 (Form 8849) (Rev. 1-2009)

Page

Reminders

any information in the certificate is false. See Model Certificate P

in Pub. 510. Only one claim may be filed with respect to any

Registered ultimate vendors of kerosene sold for nontaxable

gallon of diesel fuel.

use in noncommercial aviation are eligible to make a claim on

Allowable sales. The diesel fuel must have been sold during the

lines 3d and 3e only if the buyer waives his or her right to make

period of claim by the registered ultimate vendor for the

the claim by providing the registered ultimate vendor with an

exclusive use by a state or local government (including essential

unexpired waiver.

government use by an Indian tribal government).

Registered ultimate vendors of kerosene sold for use in foreign

Claim requirements. The following requirements must be met.

trade are eligible to make a claim on line 3f for the leaking

underground storage tank (LUST) tax if the buyer waives his or

1. The claim must be for diesel fuel sold during a period that

her right to make the claim by providing the registered ultimate

is at least 1 week.

vendor with an unexpired waiver.

2. The amount of the claim must be at least $200. To meet

Registered ultimate vendors cannot make claims for certain

this minimum, amounts from lines 1, 2, and 3 may be combined.

uses of taxable fuel if the ultimate purchaser purchased the fuel

3. The claim must be filed by the last day of the first quarter

with a credit card issued to the ultimate purchaser by the credit

following the earliest quarter of the claimant’s income tax year

card issuer. See the Cautions above lines 1a, 2a, 4a, and 5a.

included in the claim. For example, a calendar-year claimant’s

claim for diesel fuel sold during September and October must be

filed by December 31.

General Instructions

Note. If requirements 1–3 above are not met, see Annual Claims

Purpose of Schedule

under Additional Information for Schedules 1, 2, and 3 in the

Form 8849 instructions.

A registered ultimate vendor of undyed diesel fuel, undyed

kerosene, kerosene sold for use in aviation, gasoline, or aviation

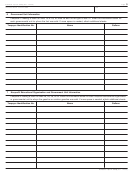

Information to be submitted. Complete Line 6, Government

gasoline uses Schedule 2 to make a claim for refund.

Unit Information, for each governmental unit to whom the diesel

fuel was sold and the number of gallons sold to each. If more

See Registration Number below if you do not have a valid regi-

space is needed, attach additional sheets.

stration number.

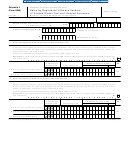

Total Refund

Line 1b. Sales by Registered Ultimate Vendors of Undyed

Diesel Fuel for Use in Certain Intercity and Local Buses

Add all amounts in column (c) and enter the result in the total

refund box at the top of the schedule.

Claimant. The registered ultimate vendor of the diesel fuel is

eligible to make a claim on line 1b only if the buyer waives his or

Registration Number

her right to make the claim by providing the registered ultimate

You must enter your registration number. You are registered if

vendor with an unexpired waiver. See Model Waiver N in Pub.

you received a letter of registration with a registration number

510. Only one claim may be filed with respect to any gallon of

from the IRS that has not been revoked or suspended. See the

diesel fuel.

list below. If you do not have a registration number, you cannot

Claim requirements. The following requirements must be met.

make this claim. Use Form 637, Application for Registration (For

Certain Excise Tax Activities), to apply for one.

1. The claim must be for diesel fuel sold during a period that

is at least 1 week.

UV. Ultimate vendor that sells undyed diesel fuel, undyed

kerosene, gasoline or aviation gasoline; lines 1a, 2a, 4a, 4b, 5a,

2. The amount of the claim must be at least $200. To meet

and 5b; and lines 3d and 3e, type of use 14.

this minimum, amounts from lines 1, 2, and 3 may be combined.

UB. Ultimate vendor that sells undyed diesel fuel or undyed

3. The claim must be filed by the last day of the first quarter

kerosene for use in certain intercity and local buses; lines 1b and

following the earliest quarter of the claimant’s income tax year

2c.

included in the claim. For example, a calendar-year claimant’s

claim for diesel fuel sold during September and October must be

UP. Ultimate vendor that sells kerosene sold from a blocked

filed by December 31.

pump; line 2b.

Note. If requirements 1–3 above are not met, see Annual Claims

UA. Ultimate vendor that sells kerosene for use in aviation;

under Additional Information for Schedules 1, 2, and 3 in the

lines 3a–3f. See UV above for lines 3d and 3e, type of use 14.

Form 8849 instructions.

Required Certificate or Waiver

Lines 2a and 2b. Sales by Registered Ultimate Vendors of

The required certificates or waivers are listed in the line

Undyed Kerosene (Other Than Kerosene For Use in

instructions and are available in Pub. 510.

Aviation)

How To File

Claimant. For line 2a, the registered ultimate vendor of the

kerosene is the only person eligible to make this claim and has

Attach Schedule 2 to Form 8849. On the envelope write

obtained the required certificate from the buyer and has no

“Registered Ultimate Vendor Claim” and mail to the IRS at the

reason to believe any information in the certificate is false. See

address under Where To File in the Form 8849 instructions.

Model Certificate P in Pub. 510. For line 2b, claimant has a

statement, if required, that contains the date of sale, name and

address of the buyer, and the number of gallons of kerosene

Specific Instructions

sold to the buyer. For lines 2a and 2b, only one claim may be

filed with respect to any gallon of kerosene.

Line 1a. Sales by Registered Ultimate Vendors of Undyed

Allowable sales. For line 2a, the kerosene must have been sold

Diesel Fuel

by the registered ultimate vendor during the period of claim for

Claimant. The registered ultimate vendor of the diesel fuel is the

the exclusive use by a state or local government (including

only person eligible to make this claim and has obtained the

essential government use by an Indian tribal government). For

required certificate from the buyer and has no reason to believe

line 2b, the kerosene must have been sold during the period of

claim from a blocked pump.

1

1 2

2 3

3 4

4 5

5