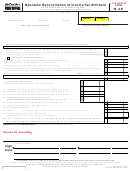

INSTRUCTIONS

WHO MUST FILE. Every employer or payor withholding Nebraska

Interest is at the rate shown on line 16. Compute by calculating the

income taxes from employees or payees must file a Nebraska

number of days from February 1 to the date of payment. Use the

Reconciliation of Income Tax Withheld, Form W-3N. You must apply

following formula to calculate the interest due:

for a withholding number on a Nebraska Tax Application, Form 20.

Tax Due x Interest x

Number

You will be issued a withholding certificate by the Nebraska

Interest Due = (line 14)

Rate

of days

Department of Revenue (Department).

365

A penalty of $2 per statement, not to exceed $2,000, may be imposed

If you are licensed for withholding, you must file a Form W-3N, even

by the Department for failure to file the state copy of any Federal

if no payments were made which were subject to withholding, or if

Withholding Forms) on or before the due date of Form W-3N, or for

the license was cancelled during the year.

failure to e-file when filing more than 50 forms.

WHEN AND WHERE TO FILE. E-file or attach the Nebraska

SPECIFIC INSTRUCTIONS

copies of the following federal withholding forms for each employee

LINES 2 THROUGH 5. Enter the total Nebraska income subject

or payee who had Nebraska income tax withheld:

to withholding as shown on all Federal Withholding Forms. When

1. Wage and Tax Statement, Federal Form W-2;

entering on lines 2 through 5, only include amounts once. These

lines must be completed regardless of the method used to file these

2. Statement for Recipients of Certain Gambling Winnings,

forms (for example, actual forms, e-filing, or combined federal/

Federal Form W-2G;

state filing).

3. Distribution from Pensions, Annuities, Retirement, or Profit-

LINE 5. Enter the amount of nonemployee compensation which was

Sharing Plans, IRAs, Insurance Contracts, etc., Federal Form

subject to withholding as nonresident personal service payments.

1099-R; and

The amount entered should be the gross amount of payment before

4. Statement for Recipients of Miscellaneous Income, Federal

deduction of expenses. Also include on this line any mandatory

Form 1099-MISC.

5% income tax withholding made by construction contractors for

payments made to subcontractors. Go to , then

Employers reporting more than 50 state copies of Forms W-2 and

click on “Construction Contractors,” for additional information.

1099 must e-file these forms. Please refer to

LINE 8. Enter on line 8 the total amount of incentive credits used

for more information on e-filing. Form W-3N can now be filed

during this reporting year. If the Department has preidentified an

using the Department’s NebFile for Business filing program.

amount on this line, you must correct it to reflect any amount of

incentive credit taken on your fourth quarter, Form 941N. If the

Form W-3N is due on February 1, 2012, along with payment of any

annual reconciliation of your withholding shows additional tax due,

amount shown on line 17. If required, payment must be made by

and you wish to offset it with available incentive credits, also add this

electronic funds transfer (EFT). Do not send any other remittance

amount to line 8. Attach the

Incentive Withholding Worksheet

which

with the Form W-3N. Checks written to the Nebraska Department of

is available at .

Revenue may be presented for payment electronically.

LINES 9 THROUGH 11. The amounts for these lines have been

EXTENSION OF TIME. An extension of time to file Form W-3N

completed with the amounts of tax reported on the quarterly returns

can be can be requested of the Department in writing. The request

received and processed by this Department. Do not change any

should include the employer’s or payor’s Nebraska ID number and

of these amounts without first contacting the Department. These

the period of time for which an extension is requested. An extension

amounts are tax only and do not include any penalty or interest paid.

may be granted for a period not to exceed 45 days from the original

No payments of penalty and interest can be applied to the tax due.

due date. Mail this request to: Nebraska Department of Revenue,

LINE 12. Enter only the amount of tax reported on line 6 of the

PO Box 98915, Lincoln NE 60509-8915.

Form 941N for the tax period ending December 31. Annual filers

Any extension granted does not extend the time allowed to submit

should enter the tax reported for the entire year. Do not include

copies of Federal Withholding Forms to employees or payees. The

any penalty and interest paid with your Form 941N.

employee’s copy must be received by February 1 following the close

LINE 17. Any balance due of $2 or more must be paid.

of the calendar year. If employment is terminated before the close

LINE 18. Any amount entered as an overpayment must be explained

of the year and the employee makes a request in writing, then the

in the space provided. As part of the explanation, include the total

employer must provide the employee’s copy of the applicable form

Nebraska income tax withheld for each quarter, and the total

within 30 days after the last payment.

Nebraska income tax paid to the Department for each quarter.

PREIDENTIFIED RETURN. Form W-3N must be used only by

An overpayment of $2 or more will be transferred to the next tax

the employer or payor whose name is printed on it. If you have not

year. The Department will verify the credit and enter it on your

received a preidentified Form W-3N for the reporting period, request

preidentified Form 941N. Do not use the resulting credit until it

a duplicate from the Department. Do not file Forms W-3N which

appears on line 12 of your preidentified Form 941N.

are photocopies, are from other tax periods, or are not preidentified.

An overpayment of $2 or more will be refunded if this is your final

If the business name, location, or mailing address is not correct,

return, or if you indicate in your explanation that the overpayment

mark through the incorrect information and plainly print the correct

exceeds the amount of tax you expect to owe next year.

information. If you file your return electronically and need to

SIGNATURES. Form W-3N must be signed by the taxpayer,

report an address change, please use the Nebraska Change Request

Form 22 which can be found at . Mail Form 22

partner, member, or corporate officer. If the taxpayer authorizes

to: Nebraska Department of Revenue, PO Box 98903, Lincoln NE

another person to sign the form, there must be a power of attorney

68509-8903.

on file with the Department.

Any person paid for preparing a taxpayer’s Form W-3N must also

PENALTY AND INTEREST. Penalty and interest are imposed

sign the form as preparer.

for failure to timely remit income tax withheld. A 5% penalty and

interest are due with this form only if a balance due is shown on

Visit , or call 800-742-7474 (NE and IA) or

402-471-5729.

line 14. If line 14 is zero or a credit, do not compute lines 15 and 16.

1

1 2

2