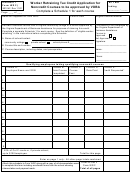

Instructions for Form WRC

Worker Retraining Tax Credit Application

it with VDBA. After processing Schedule 1, VDBA will send Form

GENERAL INFORMATION

WRC to the Department of Taxation.

The Worker Retraining Tax Credit may be claimed by employers

who provide qualifying retraining for their employees through

Step 2: Requests for Additional Information and Notification

noncredit classes approved by the Virginia Department of Business

of Authorized Credit

Assistance (VDBA) or through an apprenticeship agreement

Additional information: If the Departments of Business Assistance

approved by the Virginia Apprenticeship Council. Qualifying

or Taxation need additional information they will contact you by

apprenticeship programs may include credit and noncredit classes.

May 1 and you will have until May 15 to respond. If you have not

•

For qualified employees who attend Virginia community

received acknowledgment of your application from the Department

colleges, the employer can claim 30% of all training costs.

of Taxation by May 31 please call 804-786-2992.

•

For taxable years prior to January 1, 2013, an employer may

The Department of Taxation will issue the credit by June 30. If you

claim the actual costs up to $100 per qualified employee for

have not received your credit certification by July 15, please call

those employees who attend private schools.

804-786-2992.

•

For taxable years beginning on or after January 1, 2013, for

Extension of time for filing: If the tax return upon which this credit

those employees who attend private schools an employer

will be claimed is due on or before May 1, you may need to file an

may claim the actual costs up to $200 per qualified employee

automatic extension payment for any tax due or file an amended

or $300 per qualified employee annually if the eligible worker

return upon receipt of the credit information.

retraining includes retraining in a STEM or STEAM discipline.

Step 3: Claim Worker Retraining Tax Credit on Your Return

The total retraining credits granted to all employers is limited to

After receiving notification of authorized credit, you may claim

$2,500,000 for each year. If the total qualifying credits exceed

the credit on the applicable Virginia tax return. See the tax return

this amount, the credit will be prorated. Employers must apply

instructions for computation and attachment details.

for their share of the available credit by filing Form WRC with the

DEFINITIONS

VDBA or Department of Taxation, as applicable, to determine their

proportionate share of the credit. Notification of the authorized

Eligible Worker Retraining means the retraining of a qualified

credit amount must be received before the credit may be claimed

employee that promotes economic development. Retraining of a

on the tax return.

qualified employee will promote economic development when the

employment brings new income into Virginia, stimulates additional

The credit is allowable against the Individual Income Tax, Estate

employment, improves existing processes, products or services,

and Trust Income Tax, Corporation Income Tax, Bank Franchise

or is the basis for further economic growth. The retraining can

Tax and taxes imposed upon insurance companies and utility

be accomplished through (i) noncredit courses at any Virginia

companies (under Va. Code §§ 58.1-2501 et seq. and 58.1-2626

community college or a private school or (ii) worker retraining

et seq.). This credit is nonrefundable, but excess credit may be

programs undertaken through an apprenticeship agreement

carried forward for the next three taxable years. No credit can be

approved by the Virginia Apprenticeship Council.

carried back to a preceding taxable year.

Noncredit Courses include, but are not limited to:

PROCESS OVERVIEW FOR CLAIMING THIS CREDIT

•

specific job-related skills/studies;

Claiming this credit takes the following three-step process.

Definitions used to qualify training are after Step 3.

•

computer training due to process or equipment change

of entry-level computer skills (ongoing computer software

Step 1: Determine Eligibility of Courses or Apprenticeship

upgrades are not included);

Programs for Credit

•

continuous improvements such as team building and quality

Noncredit Courses: Employers seeking this credit will have

training;

retrained employees through noncredit courses. To determine if the

training will qualify for this credit, complete Parts I, II, and Schedule

•

management and supervisory training;

1 of Form WRC and send it to Virginia Department of Business

•

safety and environmental training programs; and

Assistance, P. O. Box 446, Richmond, VA 23218-0446. For

questions, call the VDBA at 804-371-8200. VDBA will determine

•

credit or noncredit approved apprenticeship courses.

if the course qualifies as eligible retraining. VDBA will forward this

Qualified Employee means an employee who works in a full-time

determination to Department of Taxation for Step 2.

position requiring a minimum of 1,680 hours in the normal year of

Apprenticeship Programs: Employers seeking this credit will

the employer’s operation and standard fringe benefits are offered

have retrained employees in a Virginia Apprenticeship Council

to the employee. Employees eligible to take credit or noncredit

approved program under the Voluntary Apprenticeship Act. For

courses undertaken through a registered apprenticeship agreement

program information, call Department of Labor and Industry at

must be employed in a full-time position requiring a minimum of

1,924 hours in the normal year of the employer’s operation unless

804-786-8009.

otherwise approved by the Virginia Apprenticeship Council. A

File Form WRC, completing Parts I, III and Schedule 2 (see

qualified employee shall not be a spouse, child, grandchild,

Exception below), with the Department of Taxation, Tax Credit

parent or sibling of an employer, or in the case of a corporation,

Unit, P. O. Box 715, Richmond, VA 23218-0715, to determine

an individual that owns, directly or indirectly, 5% or more of the

program applicability and authorized credit.

corporation’s stock. Employees in seasonal or temporary positions

EXCEPTION: If applying for retraining credits for noncredit courses

are not qualified for this program.

and an apprenticeship program, complete all of Form WRC and file

Page 4

1

1 2

2 3

3 4

4 5

5