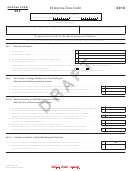

Name:

TIN:

AZ Form 306 (2012)

Page 2 of 3

Part V

Credit Calculation for Non-Dislocated Military Base Employees

(a)

(b)

(c)

Number of non-dislocated military

Allowable credit -

base employees

Credit allowed per employee

multiply column (a) by column (b)

19

New employees in fi rst

$500

year of employment

20

Employees in the second

year of continuous

$1,000

employment

Employees in the third year

21

$1,500

of continuous employment

Employees in the fourth year

22

$2,000

of continuous employment

23

Employees in the fi fth year

$2,500

of continuous employment

24

Total

Part VI S Corporation Credit Election and Shareholder’s Share of Credit

MM DD YYYY

MM DD YYYY

25 The S corporation has made an irrevocable election for the taxable year ending

to:

(CHECK ONLY ONE BOX)

Claim the military reuse zone credit shown on Part IV, line 18, column (c) and Part V, line 24, column (c)

(for the taxable year mentioned above);

OR

Pass the military reuse zone credit shown on Part IV, line 18, column (c) and Part V, line 24, column (c)

(for the taxable year mentioned above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 26 through 29 separately for each shareholder.

Furnish each shareholder with a copy of pages 1, 2 and 3 of Form 306.

26 Name of shareholder

27 Shareholder’s TIN

00

28 Shareholder’s share of the amount on Part IV, line 18, column (c) ................................................................................. 28

00

29 Shareholder’s share of the amount on Part V, line 24, column (c) .................................................................................. 29

Part VII Partner’s Share of Credit

Complete lines 30 through 33 separately for each partner.

Furnish each partner with a copy of pages 1, 2 and 3 of Form 306.

30 Name of partner

31 Partner’s TIN

00

32 Partner’s share of the amount on Part IV, line 18, column (c) ........................................................................................

32

00

33 Partner’s share of the amount on Part V, line 24, column (c) .......................................................................................... 33

ADOR 10133 (12)

1

1 2

2 3

3 4

4 5

5 6

6 7

7