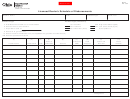

MF 2

Rev. 8/13

Page 2

Return Instructions

Line 8

Shrinkage – If your tax report is fi led and timely paid, multiply the taxable gallons on line 7 by the appropriate

shrinkage percentage. You are not entitled to the shrinkage allowance if your report is fi led and/or paid after

the due date.

Reporting Period

Shrinkage Percentage

July 1, 1993 to June 30, 2005

3% (.03)

July 1, 2005 to June 30, 2006

2.5% (.025)

July 1, 2006 to June 30, 2007

1.95% (.0195)

July 1, 2006 to June 30, 2009

1.90% (.019) – shrinkage and collection/administration discount

July 1, 2009 to June 30, 2013

1.0% (.010)

July 1, 2013 to June 30, 2015

1.0% (.010)

Line 9

Retail shrinkage – You must add back a percentage of all gallons of fuel sold to a retail dealers as defi ned in

Ohio Revised Code Section 5735.01(O). Do not include gallons sold to retail dealers licensed under your FEIN.

Reporting Period

Shrinkage Percentage

July 1, 1993 to June 30, 2005

1% (.01)

July 1, 2005 to June 30, 2006

0.83% (.0083)

July 1, 2006 to June 30, 2007

0.65% (.0065)

July 1, 2007 to June 30, 2013

0.50% (.0050)

July 1, 2013 to June 30, 2015

0.50% (.0050)

Line 11

Tax rate

Reporting Period

Tax Rate Per Gallon

July 1, 2003 to June 30, 2004

$0.24

July 1, 2004 to June 30, 2005

$0.26

Beginning July 1, 2005

$0.28

Lines 15/16 According to R.C. 5735.06(C), the tax report must be fi led/received with the tax payment shown on the report,

unless required to be submitted by EFT, by the due date. If the tax report and tax payment are not fi led/received

on or before the due date, you are liable for a “late fi ling charge” (line 15) and subject to interest (line 16) in

addition to disallowance of any shrinkage claim. The late fi ling charge is the greater of 10% of your liability (line

14) or $50. The interest is to be calculated from the date the payment was due until the date the payment was

actually received by the Ohio Treasurer of State or the Department of Taxation. The interest rate is determined

on a calendar year basis and can change from year to year. Please visit our Web site at tax.ohio.gov for the

current interest rate.

1

1 2

2