Arizona Form 140es - Individual Estimated Tax Payment Instructions - 2011 Page 2

ADVERTISEMENT

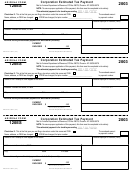

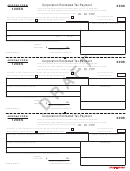

Form 140ES

2. Farmer or fisherman. If you report as a farmer or

Sending Your Payment

fisherman for federal purposes, you only have to make one

installment for a taxable year. The due date for this

Individuals may make estimated payments by check, electronic

installment for a calendar year filer is January 17, 2012. The

check, money order, or credit card.

Partnerships or S

due date for a fiscal year filer is the 15th day of the first

corporations making estimated payments on behalf of

month after the end of a fiscal year. There is no requirement

nonresidents participating in the filing of a composite return

to make this payment if you file your Arizona return on or

must make those payments by check or money order.

before March 1, 2012, and pay in full the amount stated on

Check or money order

the return as payable. Fiscal year filers must file and pay on

or before the first day of the third month after the end of the

Fill in the amount of your payment on Form 140ES. Round

fiscal year.

your payment to the nearest dollar. Your payment is the

amount you figured using the worksheet for computing

3. Nonresident alien. If you are an individual who elects to

estimated payments.

be treated as a nonresident alien on the federal income tax

return, you may make three estimated payments. The due

Make your check payable to Arizona Department of

dates for these installments are June 15, 2011, September

Revenue and mail your check along with Form 140ES to:

15, 2011, and January 17, 2012. The first installment must

Arizona Department of Revenue

equal 50% of your total required payments.

PO Box 29085

Phoenix, AZ 85038-9085.

Voluntary Payments

The department cannot accept checks or money orders in

An individual who does not have to make Arizona estimated

foreign currency. You must make payment in U.S. dollars.

income tax payments may choose to make them. Taxpayers

who make such an election may choose one of the following

Electronic payment from your checking or savings

methods to make their payments.

account

Method 1: If you file federal estimated tax, you can file an

NOTE: You may not make an electronic payment from your

Arizona Estimated Tax Payment Form 140ES at the same

checking or savings account if the payment will ultimately be

time. The amount that you remit with Form 140ES should be

coming from a foreign account. In this case, you must pay by

10%, 15%, or 20% of the amount that you paid on the

check or money order.

federal Form 1040-ES.

You can pay your 2011 estimated tax with an electronic

Method 2: You may file installments using Arizona

payment from your checking or savings account. There is

Estimated Tax Payment Form 140ES. If you are a calendar

no fee to use this method. To make an electronic payment,

year taxpayer, pay four installments by the following dates.

go to and click on the “Make a Payment”

Installment

Due Date

link. The “E-Check” option in the “Payment Method” drop-

First

April 18, 2011

down box will debit the amount from the checking or

Second

June 15, 2011

savings account that you specify. If you make an electronic

payment from your checking or savings account, you will

Third

September 15, 2011

receive

a

confirmation

number.

Please

keep

this

Fourth

January 17, 2012

confirmation number as proof of payment.

If you are a fiscal year filer, use the due dates established for

NOTE: If you are paying by electronic check, do not use

federal filing.

Form 140ES. We will apply your estimated tax payment to

The sum of the amounts remitted should equal your

your account. You must claim the estimated payment on

estimated end-of-tax-year liability.

your original return when you file.

Method 3: You may file an Arizona Estimated Tax Payment

Form 140ES with a single, lump-sum payment before

Credit card payment

January 17, 2012. The payment should reflect your

You can pay your 2011 estimated tax through a third-party

estimated end-of-tax-year liability.

service provider using your Visa, MasterCard, Discover, or

American Express credit card.

Go to ,

Record of Estimated Payments

click on the “Make a Payment” link and choose the credit

Payment #

Date Made

Amount

card option. This will take you to a third party vendor site.

Amount of 2010

The provider will charge you a convenience fee based on the

overpayment

amount of your tax payment. If you accept the credit card

applied to 2011

transaction, you will receive a confirmation number. Please

estimated tax

keep this confirmation number as proof of payment.

1

NOTE: If you are paying by credit card, do not use Form

2

140ES. We will apply your estimated tax payment to your

3

account. You must claim the estimated payment on your

4

original return when you file.

Total:

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2