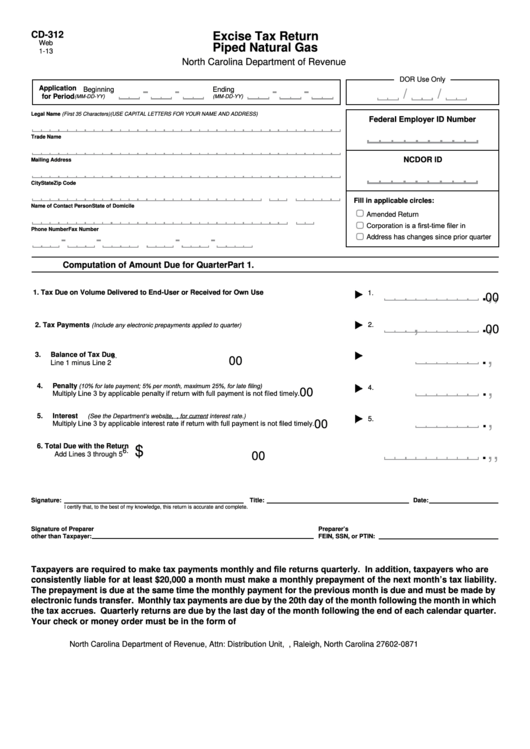

CD-312

Excise Tax Return

Web

Piped Natural Gas

1-13

North Carolina Department of Revenue

DOR Use Only

Application

Beginning

Ending

for Period

(MM-DD-YY)

(MM-DD-YY)

Legal Name (First 35 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

Trade Name

NCDOR ID

Mailing Address

City

State

Zip Code

Fill in applicable circles:

Name of Contact Person

State of Domicile

Amended Return

Corporation is a first-time filer in N.C.

Phone Number

Fax Number

Address has changes since prior quarter

Part 1.

Computation of Amount Due for Quarter

,

,

.

1.

Tax Due on Volume Delivered to End-User or Received for Own Use

1.

00

,

,

.

2.

Tax Payments

2.

(Include any electronic prepayments applied to quarter)

00

,

.

3.

Balance of Tax Due

3.

00

Line 1 minus Line 2

,

.

(10% for late payment; 5% per month, maximum 25%, for late filing)

4.

Penalty

4.

00

Multiply Line 3 by applicable penalty if return with full payment is not filed timely.

,

.

5.

Interest

(See the Department’s website, , for current interest rate.)

5.

Multiply Line 3 by applicable interest rate if return with full payment is not filed timely.

00

6.

Total Due with the Return

,

,

.

$

6.

Add Lines 3 through 5

00

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Signature of Preparer

Preparer’s

other than Taxpayer:

FEIN, SSN, or PTIN:

Taxpayers are required to make tax payments monthly and file returns quarterly. In addition, taxpayers who are

consistently liable for at least $20,000 a month must make a monthly prepayment of the next month’s tax liability.

The prepayment is due at the same time the monthly payment for the previous month is due and must be made by

electronic funds transfer. Monthly tax payments are due by the 20th day of the month following the month in which

the tax accrues. Quarterly returns are due by the last day of the month following the end of each calendar quarter.

Your check or money order must be in the form of U.S. currency from a domestic bank.

North Carolina Department of Revenue, Attn: Distribution Unit, P.O. Box 871, Raleigh, North Carolina 27602-0871

1

1 2

2