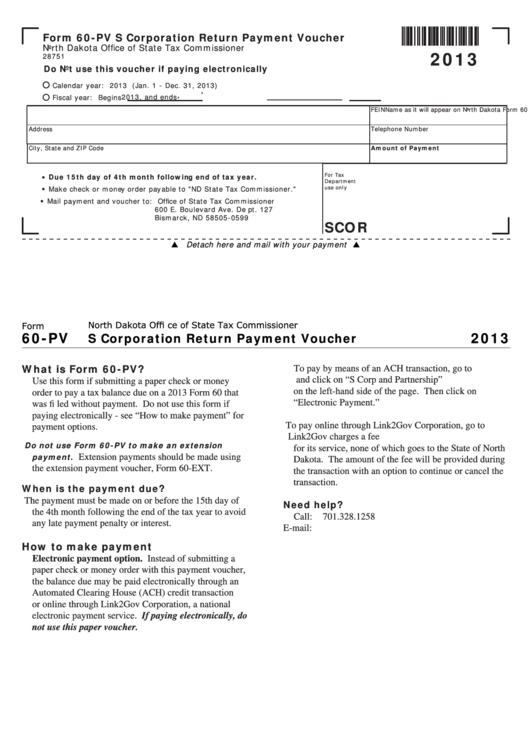

Form 60-PV S Corporation Return Payment Voucher

North Dakota Office of State Tax Commissioner

2013

28751

Do Not use this voucher if paying electronically

Calendar year: 2013 (Jan. 1 - Dec. 31, 2013)

,

,

2013, and ends

Fiscal year: Begins

Name as it will appear on North Dakota Form 60

FEIN

Telephone Number

Address

City, State and ZIP Code

Amount of Payment

For Tax

Due 15th day of 4th month following end of tax year.

•

Department

use only

Make check or money order payable to "ND State Tax Commissioner."

•

Mail payment and voucher to: Office of State Tax Commissioner

•

600 E. Boulevard Ave. Dept. 127

Bismarck, ND 58505-0599

SCOR

Detach here and mail with your payment

North Dakota Offi ce of State Tax Commissioner

Form

60-PV

2013

S Corporation Return Payment Voucher

What is Form 60-PV?

To pay by means of an ACH transaction, go to

and click on “S Corp and Partnership”

Use this form if submitting a paper check or money

on the left-hand side of the page. Then click on

order to pay a tax balance due on a 2013 Form 60 that

“Electronic Payment.”

was fi led without payment. Do not use this form if

paying electronically - see “How to make payment” for

To pay online through Link2Gov Corporation, go to

payment options.

Link2Gov charges a fee

Do not use Form 60-PV to make an extension

for its service, none of which goes to the State of North

payment.

Extension payments should be made using

Dakota. The amount of the fee will be provided during

the extension payment voucher, Form 60-EXT.

the transaction with an option to continue or cancel the

transaction.

When is the payment due?

The payment must be made on or before the 15th day of

Need help?

the 4th month following the end of the tax year to avoid

Call: 701.328.1258

any late payment penalty or interest.

E-mail: individualtax@nd.gov

How to make payment

Electronic payment option. Instead of submitting a

paper check or money order with this payment voucher,

the balance due may be paid electronically through an

Automated Clearing House (ACH) credit transaction

or online through Link2Gov Corporation, a national

electronic payment service. If paying electronically, do

not use this paper voucher.

1

1