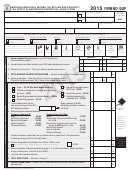

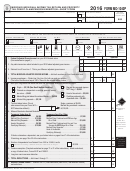

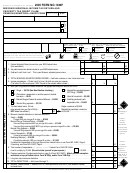

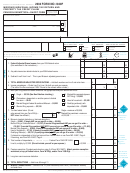

Form Mo-1040p - Missouri Individual Income Tax Return And Property Tax Credit Claim/pension Exemption - 2014 Page 32

ADVERTISEMENT

MISSOURI DEPARTMENT OF REVENUE

PRSRT STD

JEFFERSON CITY, MO 65105-2200

U.S. POSTAGE

PAID

Missouri Dept.

of Revenue

Visit our website at

In addition to electronic filing information found on our website, you can:

• Use our fill-in forms that calculate

• Pay your taxes online

• Download Missouri and federal tax forms

• Get the status of your refund or balance due

• Get answers to frequently asked questions

• Get a copy of the Taxpayer Bill of Rights

IMPORTANT PHONE NUMBERS

General Inquiry Line

(573) 751-3505

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Automated Refund/Balance Due/1099G Inquiry

(573) 526-8299

. . . . . . . . . . . . . .

Electronic Filing Information

(573) 751-3930

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Individuals with speech or hearing impairments may use TDD (800) 735-2966

or fax (573) 526-1881.

Download forms, check the status of your return, or obtain a

copy of the Taxpayer Bill of Rights on our website at:

/

.

Federal Privacy Notice

The Federal Privacy Act requires the Missouri Department of Revenue (Department) to inform taxpayers of the Department’s legal authority for requesting identifying information, including

social security numbers, and to explain why the information is needed and how the information will be used.

Chapter 143 of the Missouri Revised Statutes authorizes the Department to request information necessary to carry out the tax laws of the state of Missouri. Federal law 42 U.S.C. Section 405

(c)(2)(C) authorizes the states to require taxpayers to provide social security numbers.

The Department uses your social security number to identify you and process your tax returns and other documents, to determine and collect the correct amount of tax, to ensure you are

complying with the tax laws, and to exchange tax information with the Internal Revenue Service, other states, and the Multistate Tax Commission (Chapters 32 and 143, RSMo). In addition,

statutorily provided non-tax uses are: (1) to provide information to the Department of Higher Education with respect to applicants for financial assistance under Chapter 173, RSMo and (2)

to offset refunds against amounts due to a state agency by a person or entity (Chapter 143, RSMo). Information furnished to other agencies or persons shall be used solely for the purpose of

administering tax laws or the specific laws administered by the person having the statutory right to obtain it [as indicated above]. In addition, information may be disclosed to the public

regarding the name of a tax credit recipient and the amount issued to such recipient (Chapter 135, RSMo). (For the Department’s authority to prescribe forms and to require furnishing of

social security numbers, see Chapters 135, 143, and 144, RSMo.)

You are required to provide your social security number on your tax return. Failure to provide your social security number or providing a false social security number may result in criminal

action against you.

32

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32