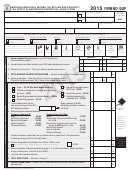

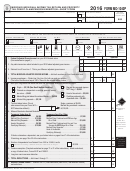

Form Mo-1040p - Missouri Individual Income Tax Return And Property Tax Credit Claim/pension Exemption - 2014 Page 8

ADVERTISEMENT

l

25 — R

Funds

Codes

The minimum contribution is $1, or

InE

EFund

$2 if married filing combined for the

American Cancer Society

Subtract Lines 23 and 24 from Line 22

Heartland Division, Inc., Fund .......... 01

fol lowing funds: Workers’ Mem orial

and enter on Line 25.

American Diabetes Association

Fund, Childhood Lead Testing Fund,

Note: If you have any other liability

Gateway Area Fund ......................... 02

Missouri Military Family Relief Fund,

due the state of Missouri, such as child

American Heart Association Fund ........ 03

General Revenue Fund, Missouri

support pay ments, or a debt with the

American Red Cross Trust Fund .......... 15

National Guard Foundation Fund, Breast

Internal Revenue Service, your income

Amyotrophic Lateral Sclerosis (ALS

Cancer Awareness Fund, Foster Care

tax refund may be applied to that

Lou Gehrig’s Disease) Fund.............. 05

and Adoptive Parents Recruitment and

lia bility in accordance with Section

Arthritis Foundation Fund ................... 09

Retention Fund, American Red Cross

143.781, RSMo. Your property tax

Breast Cancer Awareness Fund ........... 13

Trust Fund, Developmental Disabilities

credit may be applied to any property

Developmental Disabilities Waiting

Waiting List Equity Trust Fund, Puppy

tax credit or individual income tax

List Equity Trust Fund ....................... 16

Protection Trust Fund, and Pediatric

liability pursuant to Section 143.782,

Foster Care and Adoptive Parents

Cancer Research Trust Fund.

RSMo. You will be notified if your

Recruitment and Retention Fund ........ 14

The minimum contribution is $1, not

re fund is offset against any debt(s).

March of Dimes Fund ......................... 08

to exceed $200, for the following

Missouri National Guard

l

26 — A

d

InE

mount

uE

ir revo cable funds: American Cancer

Foundation Fund .................................... 19

Society Heartland Division, Inc., Fund,

Muscular Dystrophy Association Fund ... 07

If the amount due is greater than $500,

American Diabetes Asso ci a tion Gateway

National Multiple Sclerosis

you may owe an underpayment of

Society Fund .................................... 10

Area Fund, Amer ican Heart Association

estimated tax penalty. Complete Form

Pediatric Cancer Research Trust Fund ... 18

MO-2210, Underpayment of Estimated

Fund, ALS Lou Gehrig’s Disease Fund,

Puppy Protection Trust Fund .............. 17

Tax for Individuals, that can be found

Arthritis Foun da tion Fund, March of

on our website at

The minimum contribution is $2, or $4

Dimes Fund, Mus cular Dys trophy

if married filing combined for the

personal/individual/.

Association Fund, and National Multiple

following funds: Children’s Trust Fund,

Sclerosis Society Fund.

If you owe a penalty you cannot file a

Veterans Trust Fund, Elderly Home

Form MO-1040P. You must file a Form

Delivered Meals Trust Fund, Missouri

MO-1040 and attach Form MO-2210.

National Guard Trust Fund, and Organ

Donor Program Fund.

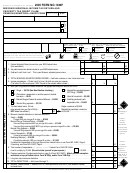

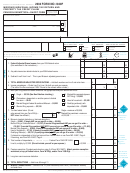

s

y

I

PlIttIng

ouR

nComE

Missouri law requires a combined return for married couples filing together.

Taxable social security benefits must be allocated by each spouse’s share of

A combined return means taxpayers are required to split their total federal

the benefits received for the year.

adjusted gross income (including other state income) between spouses when

The worksheet below lists income that is included on your federal return, along

beginning the Missouri return.

with federal line references. Find the lines that apply to your federal return,

split the income between you and your spouse, and enter the amounts on the

Splitting the income can be as easy as adding up your separate Forms W-2 and

worksheet. When you have completed the worksheet, transfer the amounts

1099. Or it may require allocating to each spouse the percentage of ownership

from Line 18 to Form MO-1040P, Lines 1Y and 1S.

in jointly held property, such as businesses, farm operations, dividends, interest,

rent, and capital gains or losses. State refunds should be split based on each

Note: Remember, the incomes listed separately on Line 18 of this worksheet

spouse’s 2013 Missouri tax withheld, less each spouse’s 2013 tax liability.

must equal your total federal adjusted gross income when added together.

The result should be each spouse’s portion of the 2013 refund.

Adjusted Gross Income Worksheet

Federal

Federal

Federal

S — Spouse

Y — Yourself

Form 1040EZ

Form 1040A

Form 1040

for Combined Return

Line Number

Line Number

Line Number

1. Wages, salaries, tips, etc. ..........................................................

1

7

7

1

00

1

00

2. Taxable interest income ............................................................

2

8a

8a

2

00

2

00

3. Dividend income ......................................................................

none

9a

9a

3

00

3

00

4. State and local income tax refunds ...........................................

none

none

10

4

00

4

00

5. Alimony received .....................................................................

none

none

11

5

00

5

00

6. Business income or (loss) ..........................................................

none

none

12

6

00

6

00

7. Capital gain or (loss) .................................................................

none

10

13

7

00

7

00

8. Other gains or (losses) ..............................................................

none

none

14

8

00

8

00

9. Taxable IRA distributions ..........................................................

none

11b

15b

9

00

9

00

10. Taxable pensions and annuities ................................................

none

12b

16b

10

00

10

00

11. Rents, royalties, partnerships, S corporations, trusts, etc. ...........

none

none

17

11

00

11

00

12. Farm income or (loss) ...............................................................

none

none

18

12

00

12

00

13. Unemployment compensation ..................................................

3

13

19

13

00

13

00

14. Taxable social security benefits ................................................

none

14b

20b

14

00

14

00

15. Other income ...........................................................................

none

none

21

15

00

15

00

16. Total (add Lines 1 through 15) ..................................................

4

15

22

16

00

16

00

17. Less: federal adjustments to income ..........................................

none

20

36

17

00

17

00

18. Federal adjusted gross income (Line 16 less Line 17)

Enter amounts here and on Line 1 of Form MO-1040P ..............

4

21

37

18

00

18

00

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32