Form Mo-1040p - Missouri Individual Income Tax Return And Property Tax Credit Claim/pension Exemption - 2014 Page 4

ADVERTISEMENT

A

I E

?

m

lIgIblE

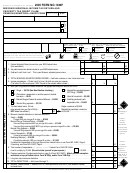

Use this diagram to determine if you or your spouse are eligible to claim the

PROPERTY TAX CREDIT (CIRCUIT BREAKER)

START DIAGRAM BY CHOOSING BOX 1 OR BOX 2 AND FOLLOW TO CONCLUSION.

NO

RENTERS / PART-YEAR OWNERS -- If single, is your total household income $27,500 or less? If married filing combined, is your

1

total household income $29,500 or less? If you are a 100 percent service connected disabled veteran, do not include VA payments.

NO

OWNED AND OCCUPIED YOUR HOME THE ENTIRE YEAR -- If single, is your total household income

2

YES

N

OR

$30,000 or less? If married filing combined, is your total household income $34,000 or less? If you are a

100 percent service connected disabled veteran, do not include VA payments.

O

YES

T

NO

Did you pay real estate taxes or rent on the home you occupied?

RENTERS: If you rent from a facility that does not pay property taxes, you are not eligible for a Property Tax Credit.

E

YES

NO

L

Can you truthfully state that you do not employ illegal or unauthorized aliens?

I

YES

G

Were you or your

Are you or your spouse

Were you 60 years

Are you or your

spouse 65 years of age

of age or older as of

100 percent disabled

I

spouse 100 percent

or older as of De cem-

as a result of military

December 31, 2014,

disabled? If so,

B

ber 31, 2014, and were

and did you receive

service?

check Box C on

NO

NO

NO

NO

you or your spouse a

If so, check Box B on

sur viving spouse social

Form MO-PTS.

L

Missouri resident the

security benefits? If so,

Form MO-PTS.

entire 2014 calendar

check Box D on Form

E

year? If so, check Box A

MO-PTS.

on Form MO-PTS.

YES

YES

YES

YES

E L I G I B L E

• have Missouri adjusted gross in come

If you wish to file a Missouri extension,

TO OBTAIN FORMS

less than the amount of your stan-

and do not expect to owe Missouri

To use the Department’s form selector

dard deduction plus the exemption

income tax, you may file an extension

or to obtain specific tax forms, visit our

amount for your filing status.

by filing Form MO-60, Appli ca tion for

website at

Note: If you are not required to file a

Extension of Time to File. An auto matic

individual/.

Mis souri return, but you received a

extension of time to file will be granted

If you need to obtain federal forms, you

Form W-2 stating you had Missouri tax

until October 15, 2015.

can go to the IRS website at

withheld, you must file your Missouri

If you receive an extension of time to file

return to get a refund of your Missouri

your federal income tax return, you will

IMPORTANT FILING

withholding. If you are not required

automatically be granted an extension

to file a Missouri return and you do

INFORMATION

of time to file your Missouri income tax

not anticipate an increase in income,

return, provided you do not expect to

you may change your Form MO W-4

This information is for guidance only

owe any additional Missouri income tax.

to “exempt” so your em ployer will

and does not state the complete law.

Attach a copy of your federal extension

not withhold Missouri tax. If you are a

F

R

IlIng

EquIREmEnts

(Federal Form 4868) with your Missouri

nonresident alien, go to our website at

income tax return when you file.

You do not have to file a Missouri

individual/

return if you are not required to file a

for in for mation.

If you expect to owe Missouri income

federal return. If you are required to

tax, file Form MO-60 with your pay-

W

t

F

hEn

o

IlE

file a federal return, you may not have

ment by the original due date of return.

The 2014 returns are due April 15, 2015.

to file a Mis souri return if you:

Remember: An extension of time to

E

t

F

• are a resident and have less than

xtEnsIon oF

ImE to

IlE

file does not extend the time to pay.

$1,200 of Missouri adjusted gross

You are not required to file an ex ten sion

A 5 percent addition to tax will apply

income;

if you do not expect to owe additional

if the tax is not paid by the original

• are a nonresident with less than

income tax or if you anticipate receiv-

return’s due date.

$600 of Missouri income; or

ing a refund.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32